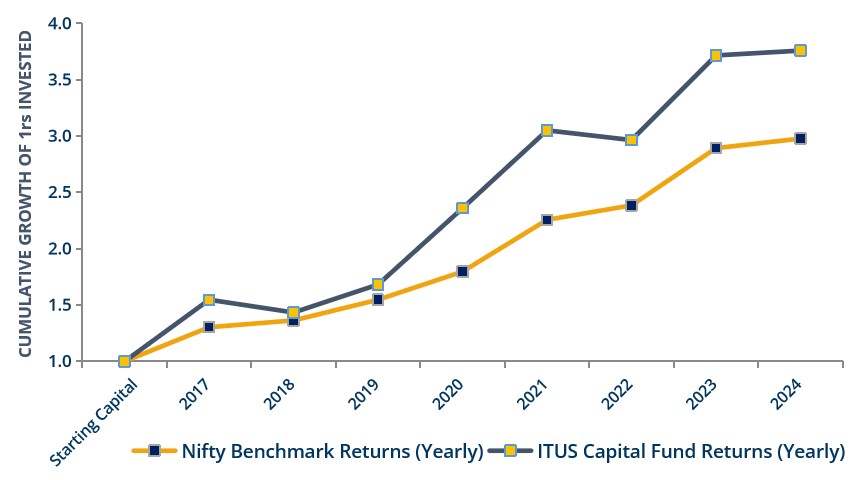

In FY’17 the fund outperformed industry

benchmarks by delivering a return of 55%.

Naveen Chandramohan

Founder and Fund Manager

We are an independent asset management firm, structured as the Porfolio Management Service in India. The firm is internally owned by our employees and we are completely invested in the fund alongside our clients.

We run a single multicap focussed fund, which ensures complete alignment of interest for our clients. We have a fiduciary responsibility to grow our client’s investments in the fund.

Our fees are determined by our performance, and we are aligned to the long term focus of wealth creation for our clients.

| At the beginning of the month | Received during the month | Resolved during the month | Pending at the end of the month |

|---|---|---|---|

| 0 | 0 | 0 | 0 |