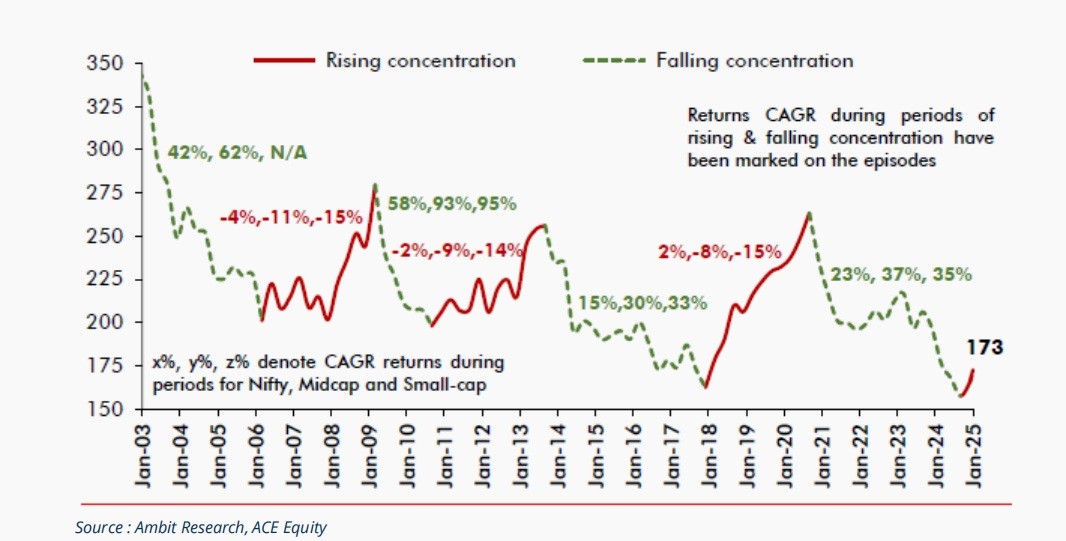

We would like to highlight a snippet from our portfolio review, which talks about the periods of concentration of earnings in the market. The below chart depicts the CAGR returns of Nifty, Midcap and Small cap index over the period from 2003 to Jan 2025. We have highlighted the positive returns periods in green and negative returns period in red.

Market concentration refers to the degree to which market cap and returns are dominated by a few large stocks. When concentration rises, it typically means that earnings in the market are narrow based, a small number of large-cap stocks (such as those in the Nifty 50) are leading the market, while midcap and small-cap stocks underperform. A falling concentration suggests a more broad-based earning and market rally where midcap and small-cap stocks contribute significantly to market gains.

The historical data presented in the chart reveals a fascinating pattern—whenever earnings across the Nifty 50, Midcap, and Small cap indices are wide spread, we see market returns contribution from all market caps and market concentration tends to fall. Conversely, when earnings narrow down, the returns decline or turn negative and thus concentration rises. Considering how the earnings were spread were spread the last 3 years, ITUS at the portfolio level also was looking a broad based portfolio with 38-40 companies. We have written multiple articles explaining why we did so. Today considering consolidation of earnings, we see market returns expectation narrow down to certain set of companies and right to win restricted to fewer companies. This has resulted in us trimming our tail and increase our top 10 exposures and today we are looking at a more concentrated portfolio of 28-30 companies.

If you would like to read about our previous articles that we wrote about concentration, please click the below link-

https://ituscapital.com/snippets/series-59-concentration-position-sizing-and-framework/

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital