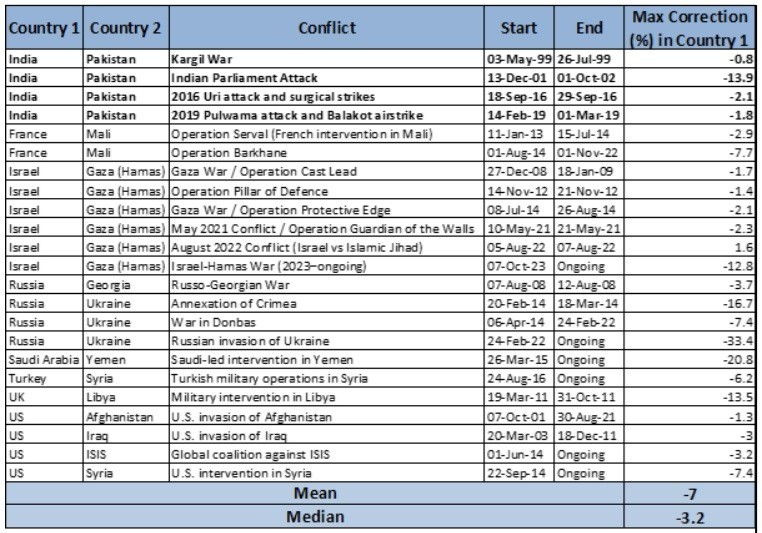

Geopolitical conflicts often stir fear among investors, leading to volatility in financial markets. However, the actual magnitude of corrections in domestic markets varies significantly across regions and events. This article analyzes the impact of various military conflicts from 1999 to 2023 on the stock markets of the involved nations, using data on maximum corrections experienced during these events.

Conflicts Involving India and Market Resilience

India has faced multiple military escalations with Pakistan over the years, including the Kargil War (1999), Parliament Attack (2001), Uri Attack (2016), and Pulwama-Balakot strikes (2019). Interestingly, the Indian markets showed relatively limited corrections, with the steepest fall of -13.9% during the Parliament Attack. The other events saw mild reactions, indicating increased market maturity or swift containment of conflict fears.

Global Conflicts: A Mixed Bag of Reactions

In contrast, global markets have reacted more sharply to some conflicts. Russia’s invasion of Ukraine in 2022 triggered the largest correction on the list at -33.4%, followed by Saudi Arabia’s intervention in Yemen (-20.8%). The U.S. and its allies faced moderate corrections in their prolonged engagements in Afghanistan, Iraq, and Syria, with drawdowns ranging from -3% to -7%. Israel’s repeated conflicts with Gaza, while frequent, typically caused only mild corrections of under -2.5%, reflecting perhaps short durations and robust local investor confidence.

Takeaway

Across all conflicts, the average market correction was -7.0%, with the median at just -3.2%, suggesting that markets don’t always react as drastically as feared. While global wars can cause volatility, many markets—including India’s—have shown a remarkable ability to absorb shocks and recover swiftly. This reinforces the wisdom of Sun Tzu’s words: “In the midst of chaos, there is also opportunity.” Geopolitical tensions may trigger fear and short-term fluctuations, but history shows that such periods can present compelling opportunities for investors who remain focused on fundamentals and avoid emotional decisions, often reaping rewards when stability returns.

We have written about how investing in volatile market can benefit your overall returns of the portfolio. You can read about it in the below link - Series 96 – Market Cycles and Investing Strategy – ITUS Capital

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program. Till we see you next week, have a great weekend!

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital