At Itus Capital, we believe market leadership is cyclical, not constant. Our investment approach is designed to adapt—rotating sector exposures based on evolving risk-reward dynamics rather than sticking to static allocations. This flexibility allows us to construct an “all-weather” portfolio that adjusts across market phases, aiming to manage risk while capturing upside potential.

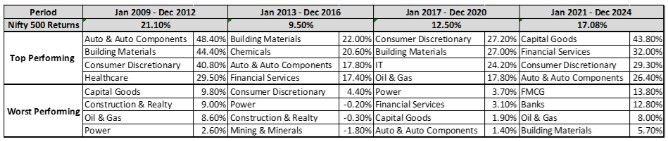

Historical data shows the rotation of sectoral leadership over 4-year periods, underscoring the need to be adaptive rather than anchored to past winners. This cyclical behavior informs our tactical positioning across portfolios.

As of June 2025, our sector weights reflect a combination of macro outlook, company-level fundamentals, and valuation attractiveness. We benchmark our exposures relative to Nifty 50 and Nifty 500, though allocations may differ across client portfolios based on entry timing.

We’ve increased our exposure to Mining & Minerals, where structural tailwinds like rising demand for critical minerals and easing macro headwinds support strong volume growth. At the same time, we remain selective in banking and lending, favoring institutions with healthy balance sheets and efficient capital allocation. In FMCG, our focus is on dominant players benefiting from the shift to volume-led growth and rural consumption recovery.

This dynamic and research-driven approach enables us to navigate market cycles effectively. By aligning sector allocations with evolving fundamentals, we aim to protect capital during downturns and generate alpha through cycles—delivering superior long-term outcomes for our investors.

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital