Last week, we shared a brief update on the key sectors driving our current positioning at ITUS Portfolio. Over the past 3 to 3.5 months, the portfolio has consistently outperformed monthly recovering strongly from the drawdown seen in January and February, due to our pharma overweight and the impact of U.S. tariff headlines.

A recurring question from our partners and clients has been: How do we expect this momentum to sustain going forward?

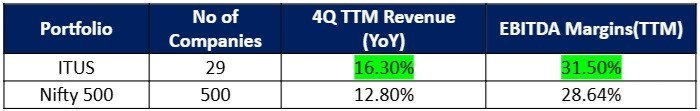

To address this, we’re sharing a simple comparative snapshot of topline growth and EBITDA margin performance between our portfolio and the Nifty 500. The data clearly highlights that our portfolio companies exhibit stronger growth and better margins. We believe this underlying strength is a key driver of sustained outperformance in the quarters ahead.

We have given a detailed breakup of the growth in each sector compared to the portfolio and Nifty 500 in our portfolio review of 4Q FY2025. You can access the same in the below link-

https://ituscapital.com/articles/portfolio-review-4q-fy25/

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital