Last week, we shared a portfolio health check update highlighting strong EBITDA and margin growth relative to the Nifty 500. Several partners asked us a common question: Why was the Nifty 500 chosen as a comparison instead of the Nifty 50? The obvious question is due to fund performance comparison benchmark being Nifty 50.

The rationale lies in the broader sectoral composition of the Nifty 500, which more closely mirrors the diversified nature of our portfolio. In contrast, the Nifty 50 is narrower in scope and less representative of our sectoral exposure.

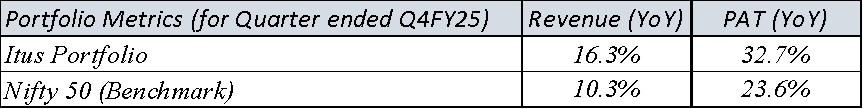

Additionally, the growth achieved within our portfolio is much higher compared to that of Nifty 50, as shown in the snapshot below—further reinforcing the confidence of outperformance in the portfolios in the coming quarters too.

A detailed update on portfolio health and key sectors under focus are detailed in our Quarterly Review. You can access the same in the below link-

https://ituscapital.com/articles/portfolio-review-4q-fy25/

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital