Last week, we shared a portfolio health check update comparing portfolios fundamentals with Nifty 50 and Nifty 500 showing a strong growth and margins expansion of ITUS portfolio relative to the benchmarks. We have been speaking about overweight positioning in pharma, despite the tariff noise in Jan and Feb, today we would want to highlight macro indicators that help us decide on the allocation in this segment. This is one question that were raised by our partners, what if the tariff is built and do we still expect drawdowns.

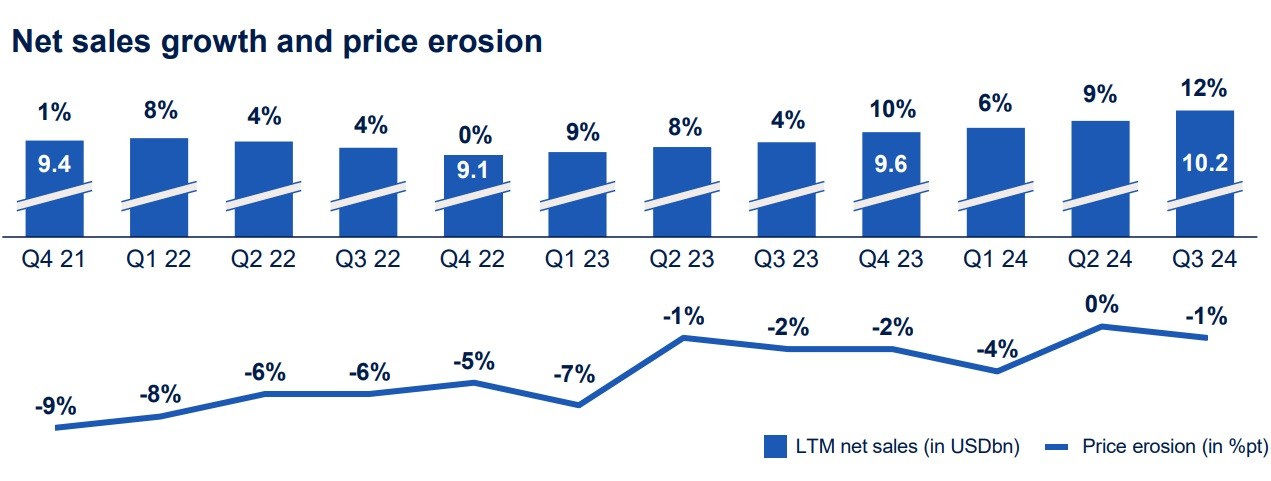

The attached chart highlights a more stable pricing environment for US-focused generics, as evidenced by Sandoz (one of the largest generic drug makers), showing slower price erosion. This trend supports a healthier backdrop for margins and volume recovery. Fundamentally we see growth potential in this segment and based on these core indicators, we’re aiming for a 15% exposure to this segment, balancing short term drawdowns as buying opportunities for long-term growth.

A detailed update on portfolio health and key sectors under focus are detailed in our Quarterly Review. You can access the same in the below link-

https://ituscapital.com/articles/portfolio-review-4q-fy25/

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital