This week we are sharing few trends on the ground that we see and how we have positioned our portfolio accordingly.

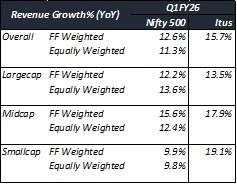

Overall earnings and margin of the portfolio is well placed than that of the benchmark that gives us the confidence of outperformance going forward too in the portfolio.

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital