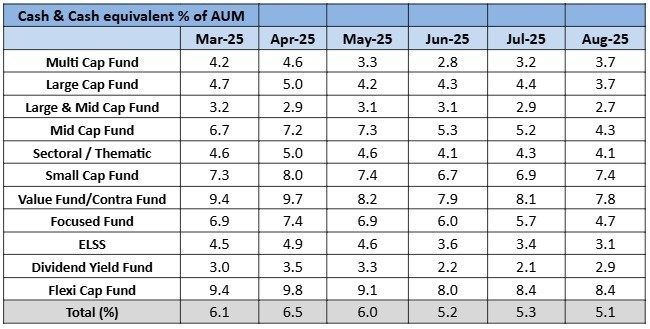

Mutual funds often hold a portion of their AUM in cash and cash equivalents to manage liquidity, meet redemptions and time fresh allocations.

The aggregate cash levels across categories tell us how fund managers perceive the risk-reward balance in equity markets.

From 6.5% in April 2025 to 5.1% in August 2025, overall cash holdings have declined steadily.

This suggests managers are becoming more confident in deploying capital despite volatile global cues.

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital