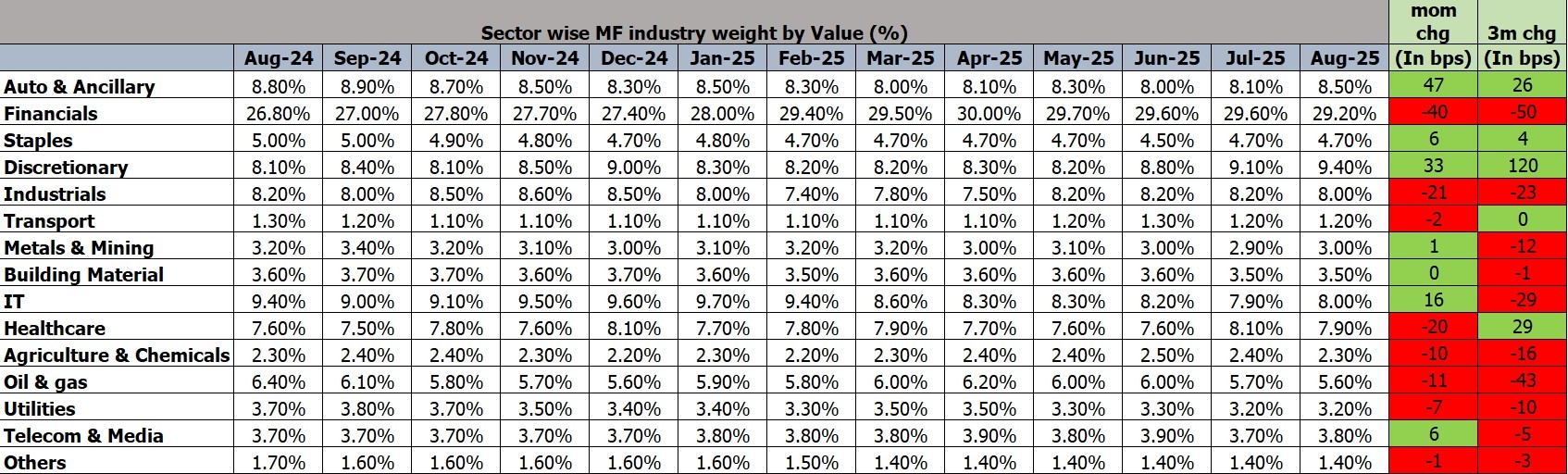

The sector-wise MF industry weight data is shown below and we would like to highlight the key insights:

1. Financials Still Dominate, But Momentum Is Slowing– Financials remain the largest sector by value (~29.2%), but have seen a steady decline over the past 3 months (-50 bps).

ITUS Reflection: Our exposure is into largest private players in banks with bottom up outlook on lending growth. Focus on Insurance, AMC’s and Fintech- with diversified view of India’s Financial deepening.

2. Discretionary Consumption Is Gaining Steam – Discretionary sector has surged (+120 bps in 3 months), indicating rising investor confidence in consumer demand.

ITUS Reflection: Discretionary reflecting premium and lifestyle demands and also with experiential and leisure consumption play.

3. Industrials and Building Materials Are Losing Steam – Industrials and Building Materials have seen mild declines (-23 bps and -1 bps respectively), suggesting a pause in infra optimism.

ITUS Reflection: Our positioning into Capital Goods, Logistics, Cement and Speciality chemicals are with the focus on execution visibility , policy tailwinds and margin resilience in the names. While we see short term sentiment drag our focus is on long term execution .

4. IT Sector Is Softening Despite Past Strength – IT weight has dropped from 9.7% to 8.0% over the last few months (-29 bps), likely due to global slowdown fears and margin pressures.

ITUS Reflection- ITUS has exposure to niche BFSI tech or ER&D plays, reflecting confidence in valuation support and AI-led growth.

5. Healthcare and Staples Are Stable Anchors – Healthcare has seen a mild uptick (+29 bps), while Staples remain flat—suggesting defensive positioning amid volatility.

ITUS Reflection: A steady allocation to pharma or FMCG would indicate risk-balanced approach. Healthcare picks are across generics, speciality and diagnostics. FMCG allocation is brand-led with strong volume and distribution.

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital