Over the last 20 years, Indian equity markets have offered significant opportunities across different segments. From March 2005 to August 2025, the Nifty 50 Time-Weighted Rate of Return (TWRR) was 12.93%, while the NSE Small Cap 250 delivered 14.71%. At first glance, small caps appear to be the superior investment choice, but entry timing is critical to realizing these gains. A closer look at 3-year rolling returns, however, highlights the volatility and risk associated with this segment.

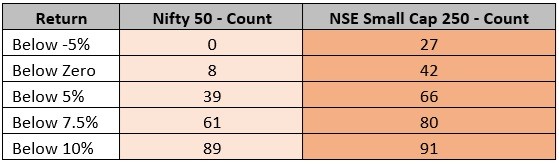

3-Year Rolling Returns (Month-on-Month) from April 2005 to August 2025 – Number of Months with Returns Below Specified Thresholds:

In the three-year rolling period, Nifty 50 had negative returns in only 8 months, compared to 42 months for small caps. Similarly, Nifty 50 delivered returns below 5% in only 39 months, while small caps did so in 66 months.

The past two decades demonstrate that small-cap stocks can generate attractive returns, but the risk of drawdowns is significant, making the entry point crucial.

At Itus Capital Advisors, our Itus Fundamental Value Fund is designed as an all-weather fund. By combining a disciplined, growth-oriented approach with sector rotation strategies, the fund aims to navigate market cycles effectively.

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manager to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Insight Digest – ITUS Capital