The previous week, we highlighted our risk mitigation strategies, where we use 5 levers to manage risk in the portfolio construction. This week we are re-emphasising our portfolio composition versus Benchmark and how we have deviated heavily from the index and our outlook.

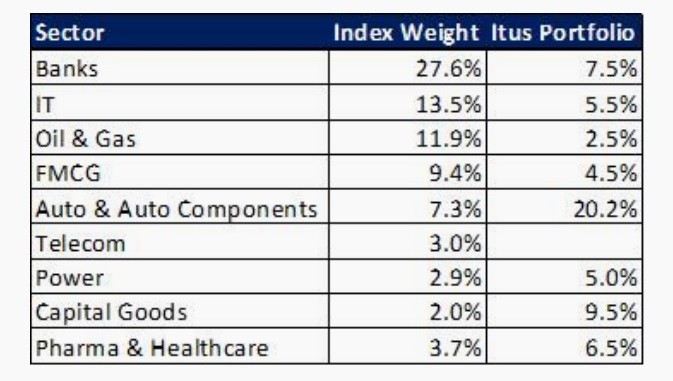

The below chart gives you a fair idea on how the ITUS portfolio behaves a contra portfolio compared to the index, which means we have intentionally targeted growth sectors that are showing strong earnings and margin expansions. We believe these sectors are poised to benefit from favourable economic conditions.

These data gives us an understanding of how the ITUS portfolio is different from typical benchmark hugged portfolios and how diversification becomes key in this kind of market. It emphasizes the importance of diversification, especially in a dynamic market like this. This unique positioning allows us to confidently request allocations from investors seeking a differentiated strategy.

Also, we keep writing to you about our SIP program that presents investors with a convenient avenue to regularly infuse capital into their portfolios. Feel free to check out the benefits for your clients. If you need more info, reach out to your dedicated relationship manager at [email protected].

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital