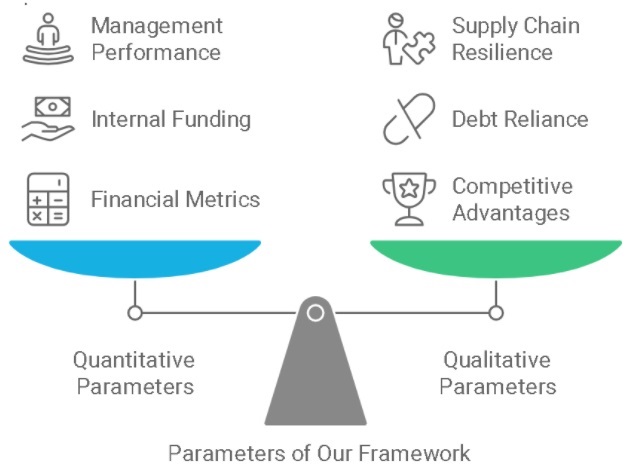

Last week, we elaborated on our research process and the crucial role data science plays in making unbiased, data-driven decisions. Our edge in consistently outperforming across cycles lies in our framework, which helps us filter great businesses from good ones. While we’ve discussed our scalable framework extensively, we want to highlight the two key parameters that help us identify great businesses during favorable cycles.

Our partners have asked how we choose one business over another within the same sector. We believe it is our responsibility to address these questions. These are the parameters guide us in making our selections and ensure we consistently choose businesses with the best potential.

These factors collectively guide our decision-making process, ensuring we select the business with the best potential for consistent performance across cycles.

And Again, We keep writing to you about our SIP program that presents investors with a convenient avenue to regularly infuse capital into the client’s portfolios. Feel free to check out the benefits for your clients. If you need more info, reach out to your dedicated relationship manager at [email protected].

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital