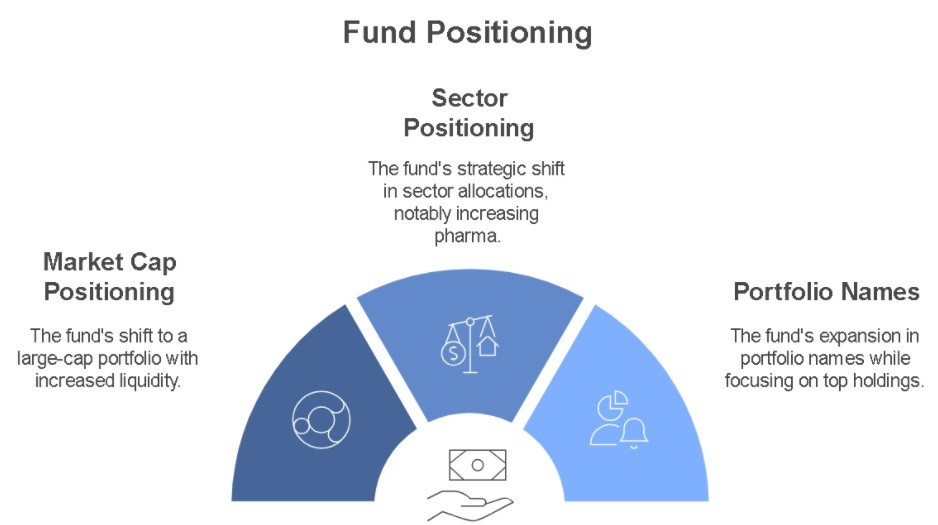

In recent weeks, the market has been quite volatile, and we believe this volatility to continue and have prepared our investor to add capital due this opportunistic period. This week, we would want to highlight the positioning of the fund in year through three aspects- market cap, sector position and number of names in the portfolio.

The fund focuses on defensive sectors like pharma, non-lending financials, consumer staples, and energy, aiming to maintain valuation discipline without relying on market timing.

We also keep writing to you about our SIP program that presents investors with a convenient avenue to regularly infuse capital into the client’s portfolios. Feel free to check out the benefits for your clients. If you need more info, reach out to your dedicated relationship manager at [email protected].

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital