Last week, we highlighted our sector positioning of the fund with respect to the benchmark and highlighted the sectors that were in focus. We have also taken pride in understanding cycles of business we own and our prudent risk management. With respect to this aspect of the portfolio, we would like to give you a case study on our thoughts on auto cycle and why we trimmed our position.

So what made us trim the auto exposure from a 22.4% in Q2Fy24 to a 6.5% Q2Fy25?

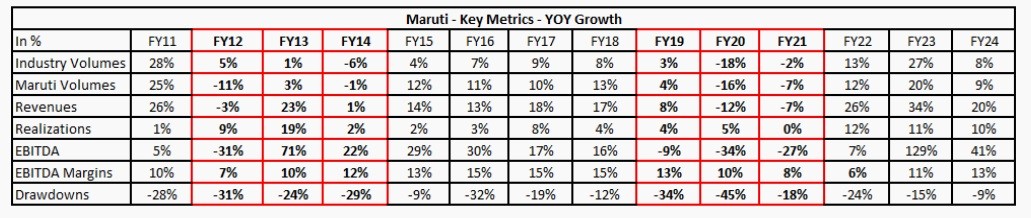

Historically, auto cycles have lasted around three years, whether in an upcycle or a downcycle. Over a 15-year period, the sector saw a 6% compounded growth rate. However, this growth came in different phases:

FY10-11: Strong growth of over 20%

FY12-14: Negative single-digit growth

FY15-18: Higher single-digit growth

FY19 onwards: A challenging period

The last three years have been a strong upcycle for the auto industry, with significant volume and realization growth. In recent years, we have observed increased competition and market share fragmentation among competitors, we are now seeing a slowdown in revenue, an increase in inventory days for major players, rising competition, and changing consumption patterns. These factors led us to reduce our positions in Auto and Auto Components, particularly in the four-wheeler segment. Our current exposure is more focused on two-wheelers and ancillary sectors.

The key highlights and more details from the sector exposure are available in our portfolio review report. This is a snapshot from our portfolio review report published in our website, to read the complete report please click on the below link-

https://ituscapital.com/articles/portfolio-review-2q-fy25/

Stay tuned for more detailed insights over the next few weeks, into our portfolio’s earnings and the themes driving our investment decisions.

We also keep writing to you about our SIP program that presents investors with a convenient avenue to regularly infuse capital into the client’s portfolios. Feel free to check out the benefits for your clients. If you need more info, reach out to your dedicated relationship manager at [email protected].

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital