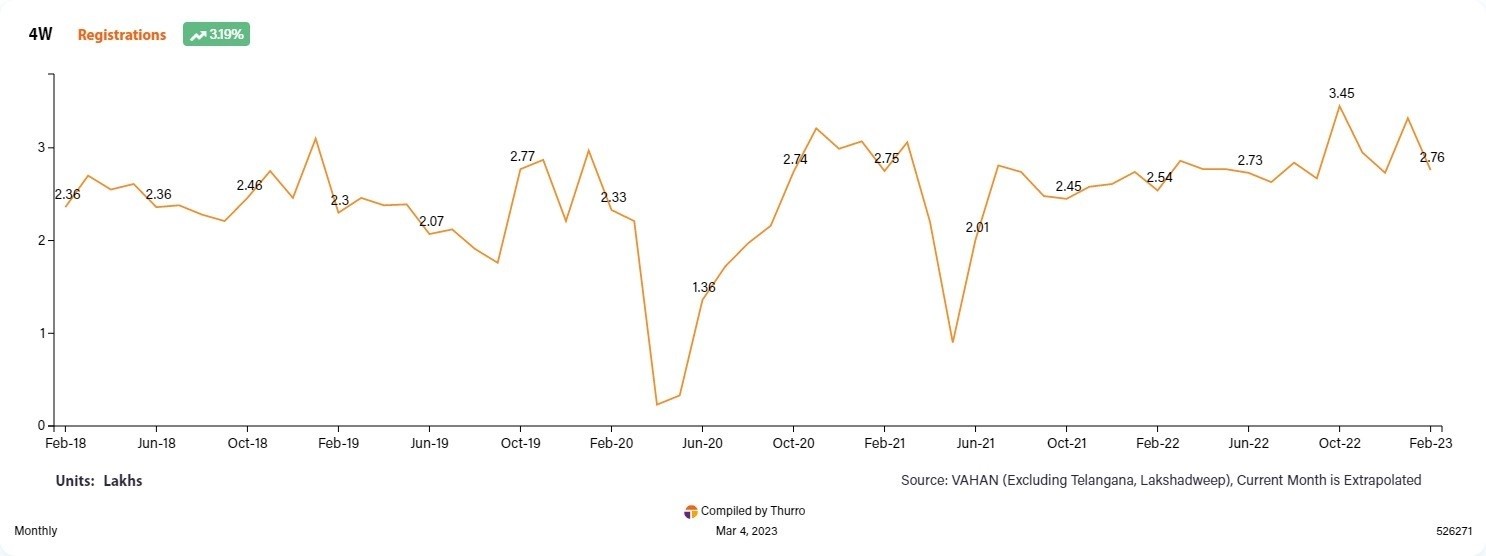

In our previous communication, we had emphasized the significance of the three key sectors, namely Banking, IT, and Automobile, which account for 60% of the Nifty 50 weights. By analysing these sectors collectively, we can gauge the long-term sustainability of the index’s earnings and growth. This week, we are focusing on the automobile sector, which is depicted in the attached charts (Chart I and Chart II). These charts illustrate the trend of four wheeler and two wheeler registrations in the country over the past five years. The charts indicates that the number of four wheeler registrations, particularly in the passenger vehicle segment, has been increasing, whereas two wheeler registrations have declined since 2018.

Considering the cyclicality of the automobile industry, we prefer investing in Auto-ancillary companies, which has strong B2B relationship with the end clients and can protect or pass on their margins. We see that these companies see a strong order book growth through both domestic and export.

We are also attaching the quarterly letter for Q1-2023, which you may forward to the clients. The letter outlines our perspective on the current market and our portfolio positioning. It also highlights the strong fundamentals of our portfolio, which continue to be resilient in spite of the challenging macroeconomic environment and global headwinds.

We will share the link to our Quarterly Investor call recording in our upcoming content next week. Our aim is to provide you with a better understanding of our portfolio through these contents.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital

As a part of our ongoing commitment to keeping you informed, we remain dedicated to our SIP program, providing investors with a convenient avenue to regularly enhance their portfolios. We encourage you to explore the benefits of this program for your clients. If you require more details, please don’t hesitate to reach out to your dedicated relationship manager at [email protected].