The financialization of the Indian capital markets has been a significant theme that has gained traction over the last decade. This has significant implications and investment opportunities across asset management, exchanges, brokerages, insurance, and market infrastructure companies. However, it’s important to understand the nature of this growth, where it has come from and the cyclicality, if any, across segments.

The capital markets in India today have often been compared to the US 25 years back, in terms of the growth of the capital markets and the penetration of financial assets and the participation in the country. The last decade (2010-2022) has given us a glimpse of the growth that India as a market has giving a framework for growth for the next 10 years. However, the Indian market and the consumer has always been and will continue to be very unique in their expectations, taste and preference and the same comes through in the capital markets too. The next few charts give a glimpse into this growth:

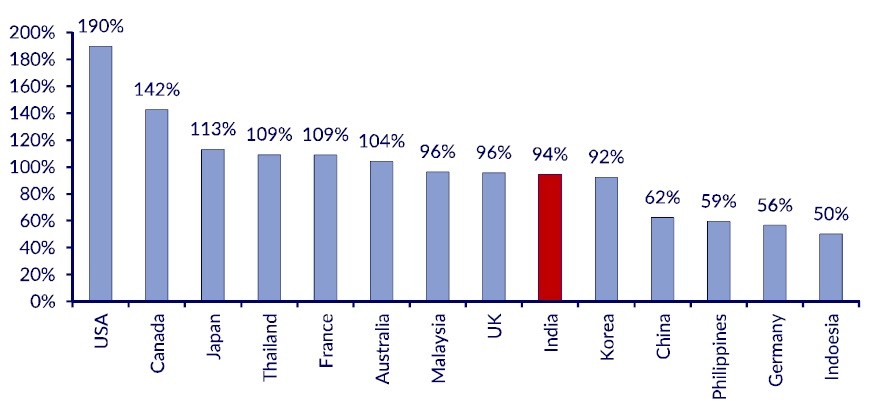

Fig 1 : Current capital markets valuation in India vs rest of the markets

Note : We are at the median of our range over the last 20 years vs the US which is a 2std dev above mean

Source : Bloomberg

Fig 2 : Equity AUM managed by funds crossed USD 200bn in FY22

Note : The CAGR of the AUM was at 15% between 2010 and 2020. The last 3Y has seen a CAGR of 25%

Source : AMFI

The EPFO ETF AUM (which started in 2016) has grown from 0 to USD 30bn to now. This contributes to 14% of the overall AUM as we stand.

Fig 3 : No. of demat accounts has grown 5x since 2014 Fig 4: No. of active NSE clients have grown 9x over the same period

Source : NSE, BSE, CDSL, NSDL, CLSA research

Note : It’s interesting to see the number of active clients grow multi-fold the number of demat accounts

Fig 5 : It’s interesting to see the NSE active client pickup has a trend with the increase in discount brokers taking market share (11% to 57% in the last 5 years)

Source : NSE, CLSA research

Fig 6 : Growth of Cash volumes on the exchange

Source : NSE, BSE

Note : It’s important to note that cash volumes on the exchange are not structural. We have seen multi-year stagnant volumes. While the long term trend is growing at 18% CAGR, that’s on the back of growth over the last 5 years

Fig 7 : growth of F&O volume on the exchange

Note : While cash volumes have been cyclical, F&O volume in India has gone through the roof. Over the last 20 years, apart from 1Y we have never seen a decline. This is one of the trends that discount brokers capitalized on significantly.

Fig 8 : F&O volume is dominated by options today

Source : NSE, CLSA

Fig 9 : We are a structural market for derivates and the worlds larges by volume. In cash, we are #4

Broad Takeaways for the reader:

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.