Reviewing Q3 FY25 at Itus (Dec 24 Earnings Quarter)

The third quarter of FY24-25 has shown characteristics of earnings as we had discussed in our previous commentaries. We had spoken about FY24 being a strong year of growth, which meant that FY25 would see a revenue growth, which would be muted due to the higher base. Around this, we wanted to ensure that our portfolio construct had characteristics of strong operating leverage (companies, who can translate the low base growth into stronger earnings and cash flows, which invariably comes from companies with strong pricing power and margin profile)

Our portfolio continues to show exactly the above characteristics (as represented in the table below). The quarter went by (December 24 – Q3FY25) saw strong annual growth in revenue and profitability across our portfolio. Growth on a YoY basis, our profitability margins grew along with robust revenue growth. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q3FY24 to Q3FY25, as compared to Q3FY23 to Q3FY24. This helps us track growth of our portfolio better, removing dependence on cyclicality in the quarter. Our portfolio companies continue to demonstrate healthy growth and profitability.

Exhibit 1: Gross Margins for Itus Portfolio over the last 8Q

We measure the health of the portfolio to give us a summary of the earning capability of our holdings. Our Portfolio has largely maintained healthy gross margins over time – which in turn has helped our businesses accrete margins with efficiencies of scale. Keep in mind, seasonality and portfolio changes may affect Gross Margins on a quarterly basis.

Exhibit 2: Top 10 sectors for Itus by weight against benchmarks

As we have mentioned in prior quarterly reviews, our portfolio is overweight Healthcare and Consumer, while we have trimmed exposure across the capex facing businesses. We continue to see tailwinds for growth and monitor the trends on the ground for additional channel-checks to re-validate our thesis and translate this into our positioning.

Below we highlight a few key updates and themes worth monitoring:

Financials: Banks and NBFC – a compelling opportunity?

In the last review, we had written about our underweight stance on lenders. This was a result of growth slowing down and the risk of asset quality deterioration stemming from tightened regulatory policies and weak macro for the industry.

While the system credit growth deceleration has manifested in moderating the growth and margins, both the private and public sector banks have done well in terms of asset quality by maintaining and improving their NPA metrics in recent periods.

Exhibit 3: NII growth and Asset quality for Public and Private banks

Market participants had been anticipating stringent regulatory measures from RBI such as lowering CD ratio (loan-to-deposit), higher capital adequacy requirement in tandem with the risk weighted assets (RWA), new ECL rules, project financing norms and a review of the LCR (liquidity coverage ratio) framework.

The latest monetary policy (Feb 2025) has come as a relief for the BFSI space. The central bank has postponed implementation of LCR & ECL framework and Project financing guidelines to beyond 2026 period. Even for CD ratio, RBI has denied mandating a fixed benchmark to achieve for the Banks.

Commentary from apex body points towards supporting liquidity flow in the system. This coupled with recent cut in Repo Rate, slashing CRR and increased open market operations points towards an environment of higher money supply in the system.

Increased liquidity is expected to benefit the growth prospects for banks in two ways:

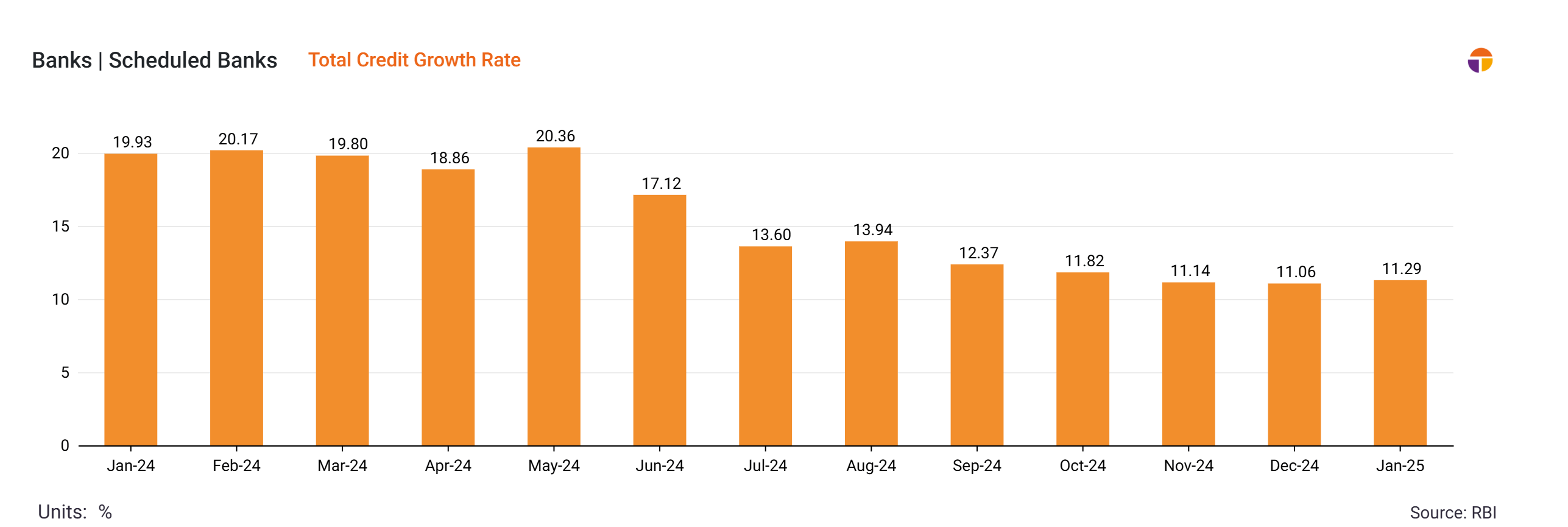

Our data enabled research points towards initial signs of bottoming in credit growth of the scheduled commercial banks. This is based on the observation that after 20% levels in CY 2024 beginning, a downward trend followed for whole year. The credit growth has been maintaining at 11% over the last three months, coming into 2025.

We continue to want to be selective in the banks we would want to own, considering the market will distinguish the loan book today, basis the quality of lending and the asset quality. We would continue to want levers around the RoA expansion of the banks and would own those that have both asset and liability franchise growth.

Positive liquidity measures on the regulatory front, players tiding over the difficult phase along with maintaining solid asset quality and valuation comfort seems to suggest that the risk to reward seems to be on the favourable side today for the larger banks.

Exhibit 5: Price/book value for Private Banks across time (source: MOFSL)

Capex under question?

India’s 2025-26 Union Budget, set the tone with the government’s focus on reducing fiscal deficit, targeted to reach 4.4% of GDP by the end of FY26. Reducing this deficit is a significant challenge for any government, as it requires a balance between the necessity for public spending (including Capex) and the objective of maintaining manageable debt levels while growing revenue streams.

In an effort to provide relief to the middle class and spur consumer demand, the central government has proposed substantial cuts to income tax rates, targeting salaried individuals earning up to 12 lakh annually. Cumulatively, this should result in a roughly 1 lakh crore tax break over the previous regime. Even with an assumption that the tax incentive would spur higher consumption growth (estimated 15% over FY25 for GST Income) we could see a potential 70,000 crore shortfall over the budgeted revenue.

Exhibit 6: Tax Revenue Breakup of Union Budget (FY19-26e)

Exhibit 7: Total Revenue Breakup of Union Budget (FY19-26e)

One of the primary areas where the government channels its expenditure is infrastructure development. Central government capital expenditure (Capex) is vital for projects such as road construction, railways, urban development, and energy infrastructure – and has downstream implications on economic growth that can affect output and demand for B2B Industrials and capex-reliant industries

Since the government has committed to maintaining the fiscal deficit (as a % of GDP) at 4.4%, this potentially means that the growth in capex will be lower than the anticipated number that has been budgeted. Over the last 5 years, we have seen the capex grow at a CAGR of 25% and we expect this number to be significantly lower this year (Refer Exhibit 9). This has implications regarding how we would position ourselves in capex facing themes, which has prompted us to reduce our exposure in the following sectors over the last few months (Industrials, Manufacturing and Power).

Exhibit 8: Capex growth comes under question (Union Budget FY19-26e)

Exhibit 9: Rate of change of Central Capex growth has shifted back to pre-2019 era

Consumption Driven Growth: Budgetary Implications

The recent budget announcements pertaining to the new income tax slabs will effectively put an extra one lakh crore in the hands of India’s middle class. We have been observing slowdown specifically in urban consumption and these measures should help address these issues and boost consumption.

Private final consumption expenditure (PFCE) is the largest component of the GDP, PFCE accounted for 56% of GDP at the end of FY24 and its average contribution to GDP over the FY11-24 period was 57%. Below is the PFCE from the FY21-24 period.

Exhibit 10: Private Final Consumption Expenditure in India (FY21-24)

PFCE has grown by 7% CAGR over the three-year period FY21-24 and this can grow higher and boost consumption in the backdrop of the recent announcements. We believe a higher portion of spending will accrue towards discretionary purchases. The same is reflected in our portfolio through exposure to 2W OEMs (through Bajaj Auto & Eicher Motors) and we are also positioned on discretionary income growth via market leaders in Jewellery (Titan Company and IGI) and Aviation (Interglobe Aviation).

To summarise, the below table gives an overview of the health of our portfolio as of Q3FY25 (with the snapshot as of January 2025).

Note: The sum of above weights would not total up to 100%; remaining would be our cash holdings.

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.