Reviewing Q1 FY26 at Itus (Jun’25 Earnings Quarter)

The first quarter of FY26 has continued characteristics of earnings as we had discussed in our previous commentaries. We had spoken about FY25 being a relatively muted year of revenue growth, due to the higher base. Around this, we wanted to ensure that our portfolio construct had characteristics of strong operating leverage (companies, which can translate the low base growth into stronger earnings and cash flows, which invariably comes from companies with strong pricing power and margin profile)

The quarter went by (June 25 – Q1FY26) saw strong annual growth in revenue and profitability across our portfolio. Growth on a YoY basis, our profitability margins grew along with robust revenue growth. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For year-on-year (YoY) comparisons, we have used a rolling four-quarter format – Q1FY25 to Q1FY26 compared with Q1FY24 to Q1FY25. This approach allows us to better assess the portfolio’s growth by minimizing the impact of quarterly seasonality. Our portfolio companies continue to show steady growth and maintain healthy profitability.

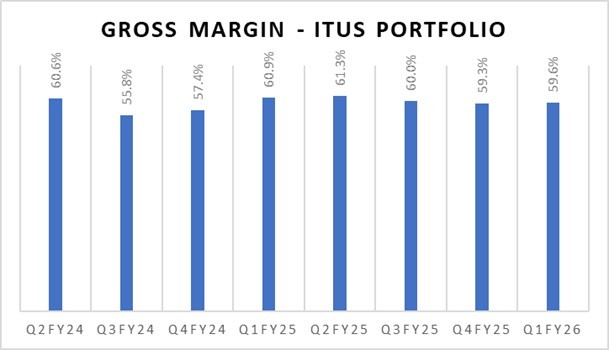

Exhibit 1: Gross Margins for Itus Portfolio over the last 8Q

We measure the health of the portfolio to give us a summary of the earnings capability of our holdings. Our Portfolio has largely maintained healthy gross margins over time – which in turn has helped our businesses accrete margins with efficiencies of scale. Keep in mind, seasonality and portfolio changes may affect Gross Margins on a quarterly basis.

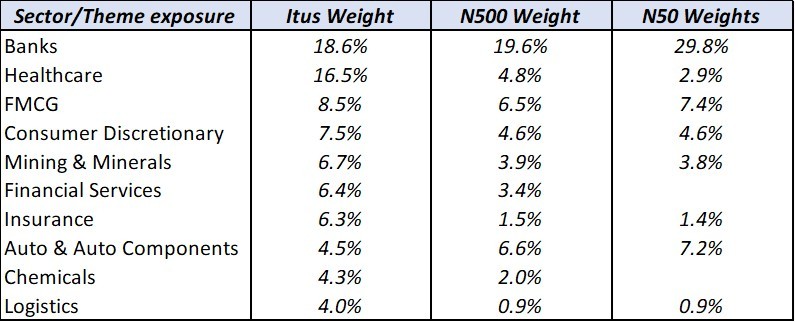

Exhibit 2: Top 10 sectors for Itus by weight against benchmarks

As we have mentioned in prior quarterly reviews, our portfolio is overweight Healthcare and Consumer, while we have trimmed exposure across the capex facing businesses. We continue to see tailwinds for growth and monitor the trends on the ground for additional channel-checks to re-validate our thesis and translate this into our positioning.

Below we highlight a few key updates and themes worth monitoring:

GST 2.0: India’s Push to Consumption-led growth

The recent announcement by the government proposing the overhaul of the current GST structure to a simplified two slab system is aimed at strengthening domestic consumption, making essential goods cheaper and reducing disputes. The proposal includes

If the above proposal is implemented the sectors that broadly stand to benefit are consumer durables, automobiles, cement, staples/FMCG and retail. Sectors that would be impacted on the back of higher taxation include tobacco, alcohol, luxury goods and high-end SUVs.

Exhibit 3: Products under the 12% and 28% bracket under the various sectors

The next step for implementation would be the meeting of the GST council to review the proposal. Any change requires 2/3rd majority approval in the council, where the centre holds 1/3rd of the vote and states 2/3rd.

Exhibit 4: GST revenue (slab-wise) for FY25. The 18% slab constitutes bulk of revenue (not impacted)

GST income in FY25 contributed INR 11.3 trillion (~29% of overall Tax Revenue) towards the union budget in FY25. The recent proposed changes to the GST would see a movement of 28% slab rate into the 18% rate, and the 12% slab rate blended into the 5% rate – which would cumulatively result in a -6% lower revenue from GST income, translating to a revenue shortfall of ~68,000cr (assumed on FY25 base).

To offset the GST revenue shortfall, India would require a consumption growth >17%, to potentially maintain the target fiscal deficit, while having the budget to spend for its Capex plans at a central level. While caution is warranted when positioning in Infrastructure and Capex-heavy sectors, the government has additional measures it can take to maintain revenue neutrality:

At ITUS, we are positioned in 2W, construction materials, FMCG and consumer discretionary and as the situation progresses, we will evaluate investment opportunities in the sectors that will see tailwinds on the back of this reform being implemented.

Lending: Landscape

The current macro is characterized by regulatory policies that remain supportive for growth – rate cuts, easing of risk weights from RBI and tax cuts, revision in GST rates from the Government. At a time when both the credit and deposit growth for the banking system continues to have moderated (10% each), the proactive stance of regulators to boost liquidity instils confidence.

Exhibit 5: Credit and Deposit growth for the Banking sector over the last 2Y

Despite heightened volatility from trade tariffs and other geopolitical uncertainties, the domestic outlook seems stable due to good monsoon, lower food inflation and growth measures. While credit growth is expected to gradually pick up, the commentaries remain cautious for the near-term – particularly in the unsecured pockets. (personal loans, credit cards and micro finance loans)

Managements are emphasizing the need to pursue opportunities selectively at attractive yields. This approach is seen as critical to mitigating the impact of rate cuts on margins (NIMs). Additionally, the banks are reducing deposit rates and repricing borrowings to enhance the margins. SME lending (especially collateral-backed) has been one of the leading growth segments for players. The macro in gold and housing demand are acting as catalysts for driving the surge in business loans.

While some lenders reported stabilization or early improvement in unsecured retail credit, others flagged pockets of stress still being elevated, especially in small-ticket size loans (< INR 1 Mn). The issues seem to be both regional and sectoral in nature. A number of microfinance players have front-loaded provisions, impacting profitability. The expectation is for incremental stress and credit cost to start tapering off from H2 of FY 26.

High customer leverage (multiple loans) has been identified as a key pain point leading to stress.

Exhibit 6: % of Borrowers with multiple live lenders (Source: TransUnion CIBIL India)

A clear strategic pivot towards secured products is emerging to manage risk while maintaining growth. This trend is evident across NBFCs as well where the focus on asset-backed financing is going up. For large banks (private and public), the asset quality trends seem to be stable, barring slippages which are either seasonal (Agri) or one-offs due to technical reclassification. PSU banks are experiencing treasury gains. This is from maintaining larger statutory portfolios and investment book than required, creating a substantial buffer that benefits from softening bond yields.

We prefer large pvt banks and regional banks with secured book for growth profile being faster than system accompanied by robust asset quality. Accordingly, our portfolio today reflects this view.

How do we translate our outlook to positioning?

Over the last 3Y, the earnings of corporate India were strong, broad-based and this resulted in a strong ROCE accretion across Large, Mid and Smallcap.

In a market environment with potential macro headwinds, building a portfolio around margins and downside protection becomes imperative. Looking ahead, we believe earnings will increasingly concentrate among a smaller set of companies – those with pricing power and a sustainable competitive edge driven by distribution, IP, technology, or operational excellence. The below table highlights the same aspect in terms of topline growth in Q1FY26 against Q1FY25.

Exhibit 7: Growth across N500 (split into Large, Mid and Small)

Exhibit 8: Positioning across Market Caps (Itus Portfolio – July 2025)

The higher equally weighted revenue growth in large caps indicates that earnings are currently concentrated among market leaders—across large caps and in selected midcaps. In contrast, small caps, despite having done well over the past three years, often lack characteristics of pricing power and would face a period of slower/declining growth. At Itus, our portfolio positioning aligns with this view.

To summarise, the below table gives an overview of the health of our portfolio as of Q1FY26 (with the snapshot as of July 2025)

Note: The sum of above weights would not total up to 100%; remaining would be our cash holdings.

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.