Portfolio Health Check – 1Q FY22

The quarter went by saw strong earnings growth in our portfolio companies with the cash flow growth of our investments growing by double digits. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Private Sector Banking: Shifting Focus

One of the trends we’ve spotted coming into this quarter, pertains to the divide between the private sector lenders, with ICICI Bank and Axis bank on one end – noticeably shifting towards a retail-focused loan book mix from corporate banking. In the table below, although there is some inter-segment overlap, we can see the retail revenue for ICICI and Axis Bank increasing from Q1FY21 to Q1FY22, while wholesale revenues are in decline. On the other hand, we see HDFC Bank do the exact opposite and while its retail loan book has grown 9.3% since Q1FY21, it has been outpaced by the 25.1% seen in the corporate segment. The growth of the retail book has come predominantly from the unsecured segment and we would be monitoring the NPAs over the course of the next year (while the onset of BNPL Schemes are a cause for concern, this is a trend to watch out for over the next few years).

AMCs: A comparative outlook

At the outset, it is imperative to understand the dynamics of an asset management business. The key lever for its revenue growth lies in the assets it manages, which could grow organically (through returns) as well as inorganically (though fresh inflows from investors). In our portfolios, we own HDFC AMC and UTI AMC – although structurally the same, they are different in what could drive growth for them.

As we see below, HDFC AMC is the most efficient of the lot in managing its expenses in comparison to UTI and Nippon, partly due to scale of its AUM (4.16 trillion INR as of Q1FY22). As a fund, however, they had seen significant under performance between FY15-19 which led to distribution networks tapering off. However, with initial signs of performance coming through, their AUM growth can pick up over the next few quarters / years. As for UTI AMC, in the past, they had faced burgeoning employee costs due to unionisation (being a government-backed company). However, we expect this cost to remain stable as they scale in AUM, allowing for a lower cost to AUM ratio, which would directly impact the bottomline positively. Additionally, we have noticed that across the board the equity-mix of the AUM rising, which leads to higher yield. UTI has moved from 42.2% to 42.6% during Q1FY22 and HDFC has moved from 42% to 42.5%.

The below table breaks down the revenues and costs for each AMC (as a % of the AUM) to give a granular perspective of each from the aspect of growth and efficiency :

Generic Pharmaceuticals (US focused): Pricing Pressure

Something that has become evident over the last quarter is that the US focussed generic pharmaceutical companies have all complained about the effect of pricing pressure. Our portfolios consist of two of the following 3 companies (which has a US focussed portfolio) we shall detail below. To paint a picture, we can see the gross margin contraction has been seen in this quarter across the board.

The business of generic pharmaceuticals is premised on drugs that are freshly about to fall off the patent cliff, which is researched upon by the companies in question and sent for regulatory approval to the US Food and Drug Administration (USFDA). In the initial period after approval, there are only a few players, allowing for higher-margins – which erodes as newer entrants arrive. In FY21 and leading into Q1FY22, we have seen USFDA Abbreviated New Drug Approvals (ANDA) applications pending in on a backlog (1,014 in CY19 of which 10% were tentative vs 909 in CY20 of which 18% were tentative). The cycle of a high-margin generic drug could vary from 3 years to 7-8 years, depending upon the market size and competition. Alembic Pharma, for example, saw its drug Sartans at the end of its high-margin cycle as 3 other companies newly entered the market in FY21.

As long-term investors, we project that this issue should normalise once ANDA application approvals and USFDA inspections for new facilities come to a full swing.

A comparison of the margins of 3 companies which have a significant US exposure has been provided below to give a perspective of the contraction of margins :

Alembic Pharmaceuticals Limited

Alembic Pharmaceuticals (APLLTD) manufactures and markets generic pharmaceuticals and Active Pharmaceutical Ingredients (APIs) internationally with its key markets being the US and India. During the quarter Q1FY22, Alembic saw their revenues grow 3.3% but net profit fall by -34.38% over Q4FY21 owing to a surge in pricing pressure on Sartans, a drug that comprised 35% of their US portfolio revenue.

However, this has to be taken in context of quarterly volatility and to their overall growth, as the India generics revenue grew 34% in Q1FY22 vs Q4FY21 and API revenue grew by 30% in the same time period. During the quarter, they have also gotten USFDA approvals for several drug applications, which could ensure a steady stream of high-margin revenue.

Alkem Laboratories Limited

Alkem Laboratories is a manufacturer of generic pharmaceuticals, APIs and other specialty molecules. In Q1FY22, Alkem reported a 35.71% increase in revenues but only 13.48% growth in net profit over Q1FY21 due to 9.3% contraction on the US formulations. However, their international business sales (excluding US) grew by 56.4% and India sales increased by 65.3% over Q1FY21.

This was driven by growth in their chronic therapies such as Neuro (+38.9%), Cardiac (+24.9%), and Dermatological (+51.1%). The company was also on the receiving end of a USFDA inspection in June for its US Formulations plant in St. Louis – for which it is yet to get final regulatory approval.

Balkrishna Industries Limited

Balkrishna Industries is a manufacturer of Off-Highway tyre manufacturers, focused on agricultural, construction and industrial applications of tyres. They have seen a 3.8% growth in revenue and a -13.0% decline in net profit in Q1FY22 over Q4FY21. In terms of volume, they had sales of 68,608MT during Q1FY22 – which represents 96% of installed capacity (quarterly).

Their growth came from agricultural segment which represented 65.9% of overall sales in Q1FY22 vs 64% in Q4FY21. In light of potential capacity constraint, Balkrishna has invested 1900 crores in brownfield expansion of their Bhuj plant, as well as increased carbon black capacity to 200,000 MTPA, which includes 30,000 MTPA for advanced carbons.

Computer Age Management Services Limited

CAMS is a financial infrastructure and services provider to Mutual Funds and financial institutions, with a market share of roughly ~69.6% of the total assets under management. During Q1 FY22, their revenue grew by 0.86% and net profit by 5.18%.

The growth in average AUM serviced during Q1FY22 was 3.42%. The company saw a degrowth in -8.5% degrowth in their non-asset based revenue, which led to the disparity in revenue growth. However, we expect their topline to scale alongside industry AUM at 10-15% annually, in line with the Mutual fund Industry’s growth.

Galaxy Surfactants Limited

Galaxy Surfactants is one of India’s leading manufacturers of surfactants and other specialty ingredients, exclusively focused on the personal care and home care industries. The company’s volume growth in this quarter stood at 15.4% over Q1FY21, with growth coming from their speciality care volumes (+36.1%) and a sharp recovery in Rest of the World segment (+28.3%) which was subdued due to the pandemic.

Over the quarter, there was a dip in their margins (36.43% in FY21 vs 28.25% in Q1FY22) due to large increase in raw material (Lauryl Alcohol) costs. We believe that given the monopolistic nature of the business and the long-term stickiness of the client base, the company has ability to price accordingly, which should normalise over the next few quarters.

HDFC Asset Management Company Limited

HDFC AMC is one of a handful of publicly listed asset management companies in India. Their primary driver of revenue is based on the AUM they manage, which grew 9.1% in Q1FY21 over Q4FY21. This reflected in a 11.4% growth in revenue and 9.3% growth in net profit during Q1FY22.

While the fund’s current performance elucidates our confidence in the management, their growth in the near term could be slower due to the funds in the AMC coming off a period of relative underperformance. Their absolute SIP transactions (an indicator of inorganic growth) have fallen -7.8% since Q2FY20, while the overall MF industry SIP flows have gone up 1.8% in the same time.

HDFC Bank Limited

During Q1FY22, HDFC Bank has seen its pre-provisioning operating profit decline by -5.94% and its net profit by -5.97% while on a yearly basis over Q1FY21, grew 16.9% and 14.4% respectively. The bank’s retail loan book grew by 9.3%, and corporate banking loan book grew by 25.1% in comparison to Q4 FY21. As long-term investors, we feel that the bank continues to show strong signs of stability and revenue growth, with CASA growth at 13.2% and Branch Growth at 6.3% in Q1FY22 as compared to Q1FY21.

HDFC Life Insurance Company Ltd

HDFC Life Insurance is the 3rd largest life insurance company in India in terms of Annualised Premium Equivalent (APE). During Q1FY22, their collections dropped by -45.8% and net profit by -37.5% owing to the coronavirus lockdowns in several states. However, over Q1FY21, the APE increased by 30.3%. As expected, the majority of these collections are likely be fulfilled in the coming quarters.

The company their VNB margin slightly rise to 26.2% from 25.8% in Q1FY21. We believe that despite higher provisioning and pay-outs in the short-term, the pandemic has created an increasing adoption for life insurance of which we will continue to see tailwinds. It is our belief that the company has the capability to grow cash flows ~25-30% once the collections resume and provision rates lower to pre-pandemic levels. The company has been focussed on increasing its group and non-par business in its APE mix with an increased focus on risk management in the near term.

ICICI Bank Limited

ICICI Bank has seen its pre-provisioning operating profits grow by 4.16% and net profits by 4.5% during Q1FY22. A key component that aids our confidence in ICICI Bank is their CASA growth has been strong at 20.5% and Net Interest Margin has been on an increasing trend – at 3.89% in Q1FY22 over 3.69% in Q1 last year.

On an efficiency standpoint, the asset quality (measured by the gross NPA %) of the company increased to 3.75% in Q1FY22 from 3.04% in Q4FY21. We believe that in the longer term, the loan book growth and ICICI’s investment in technology would lead to healthy PPOP growth of ~15-20% annually. We will continue to monitor the growth and performance of the unsecured loan book as the bank continues to show a healthy top-line growth.

ICICI Lombard Gen Insurance Co Ltd

ICICI Lombard General Insurance Ltd. is among the largest private sector general insurance companies in India. Its revenues in Q1FY22 grew by 18.9% and net profit declined by -61.91% over Q1FY22. This was due to significantly higher provisioning owing to drop in retention ratios induced because of the pandemic. A great sign for their business, premium income from each of their segments grew with performance in fire insurance (+37.2%), retail health (+15.1%) and motor insurance (+14.2%) leading the way.

We are of the view that with health insurance seeing a significant increase in number of policy holders and mandatory requirement for motor insurance for all vehicles, the general insurance industry is at in inflection point. ICICI Lombard is among the market leaders in the private space and could see a 20% growth in its premiums annually.

IndiaMart Intermesh Limited

Indiamart Intermesh is India’s largest online B2B marketplace, connecting buyers with suppliers and has a 60% market share of the online B2B Classifieds space in India. In Q1FY22, the company’s revenue grew 11% and net profit grew 57% over Q4FY21. Although the number of paying suppliers dropped by 3.9%, registered buyers increased by 22.4% during this quarter. It is interesting to note that only subscribers from the lower tiers have dropped off as the average revenue per paying subscriber (ARPU) increased by 5.7%.

Indian Energy Exchange Limited

Indian Energy Exchange (IEX) is an energy exchange platform that facilitates the short-term trading of power in India. The company’s revenue has grown by 26.8% and net profit by 48.0% in Q1FY22 over Q1FY21.

Currently, the volumes traded on IEX constitutes only 6.3% (74 billion units in FY21) of the total power generated in India annually (of which 12% is short-term). During this quarter, the company announced the launch of a new product, that would allow them to target a larger share of the short-term market. The company has begun cross-border trade with Nepal (volumes of 178 MU) during Q1 and will later expand to Bangladesh and Bhutan. We believe that the combination of the company’s monopolistic nature (96% market share) and an underserved market will provide an ideal environment for a ~20% growth in cash flows annually.

Indoco Remedies Limited

Indoco Remedies is a generic pharmaceutical company engaged in the manufacturing and marketing of Finished Dosages – with its key markets in India and the US. The company’s revenue in Q1FY22 grew by 40.3% and net profit by 209.4% over Q1 last year, with most of their regulatory troubles with the USFDA resolved, and sales returning in key segments of their domestic formulations that were afflicted by the lockdown last year. Of their key segments, Anti-Infectives and Respiratory remedies, saw revenues grow by 170% and 140.4% respectively over Q1FY21.

Additionally, during this quarter, Indoco obtained USFDA approval to manufacture brinzolamide, a drug with an estimated market size of $184 million annually, for which it is the only generic in the US market. As long-term investors, we expect the growth in sales to continue, driven by newer products in regulated international markets, at a pace of 15% annually.

Infosys Limited

Infosys, among its IT counterparts has been consistent at generating strong cash flow growth. During this quarter, Infosys saw its revenues grow 8.3% and net profit by 2.4%, on account of normalisation of expenses. Their EBITDA margin dropped from 24.1% in FY21 to 23% in Q1FY22.

A great sign of business, Infosys’ repeat business percentage remains at 96% – an indication of the clients’ trust in them. The company had large deal wins of $2.6 Billion in Q1, with revenues majorly coming from growth in North America and Asia. Despite the drop in margins, we continue to view Infosys’s ability to generate cash flow growth at ~15% annually.

L & T Technology Services Limited

L&T Technological Services (LTTS) is a pure-play engineering services provider, that primarily engages in engineering design and product development. The company’s revenue and net profit for Q1FY22 increased by 19.4% and 19.7% respectively over Q1FY21, with revenues seeping in from large deal wins in the previous quarters. Segmental revenue saw increase across the board, especially in Industrial Products (+7.5%) and Process Industry (+4.5%).

The company also announced a partnership with Mavenir – to test end-to-end 5G automation, which will boost their capability to increasingly gain similar projects. LTTS’s revenue mix has been significantly shifting towards digital engineering (54% in Q1FY22 vs 48% in Q1FY21). Considering the above factors play out, we believe that LTTS will be a big benefactor in the long-run.

Lupin Limited

Lupin is a complex generics pharmaceuticals and Active Pharmaceutical Ingredients manufacturer that primarily caters to the US and India markets. During Q1FY22, its revenue rose by 12.7% and net profit by 18.04%, driven by India formulations (+27.1%) over Q4FY21. However, the US generics faced pricing pressure, declining by -9.8%.

In terms of their product pipeline, their focus on maximizing respiratory generic opportunities – in Albuterol and Brovana. The company is also pending regulatory approval on its biosimilars drug from the USFDA. While we monitor the health of the US generics environment, we expect Lupin to scale their India branded generics and API segments to generate 20% volume gains annually.

MCX India Limited

Multi Commodity Exchange (MCX) primarily deals with trading of derivatives contracts across various segments including bullion, industrial metals, energy and agricultural commodities. During Q1FY22, we have exited our positions in MCX as the levers we expected in growth, over the last 1.5 years (due to some of the benefits of the lock-down) failing to materialize.

During FY21, the volume of contracts (in number of lots) fell -30% to 204 million in FY21, which brought them to levels similar to FY17-18. However, the revenues for the company in FY21 were 55% higher than the corresponding period, which tells us that the primary driver of revenue growth has been commodity inflation. Moreover, the average daily turnover of the platform declined to 28,000 crores in Q1FY22, 15% lower than in FY20. This was a result of SEBI imposing peak margin norms – although in a phased manner, essentially reduced the value of contracts that could be traded for the same margin.

Another key concern pertains to the decline in number of active clients. Number of active trading clients went up to 4.57 Lakh in FY21 from 4 Lakh FY20 (14%). Yet the number of unique average clients that traded on a daily basis is 55,000 clients, down from 62,000. The company is adversely affected by the number of active clients as this is a potential proxy for volumes growth. We wanted to see exchange volume and number of transactions go up significantly (a trend we saw across the board with other exchanges – be it for NSE and BSE for equities, and IEX for power). However, there has been a de-growth in the numbers from an onboarding perspective on the exchange. While the investment has given us a health 34% IRR since the time we made our first investment, we believe its prudent to completely exit the position from our portfolio.

Orient Electric Limited

Orient Electric is a consumer electricals brand that is a part of the CK Birla group of companies. During this quarter, the company’s revenues grew 140% over Q1FY21 but declined by -46% over Q4FY21 due to impact of lockdowns. The company’s Electrical Consumer Durables (ECD) business grew by 77% share of revenue from 58% in Q1FY21 but gross margins declined 1.4% over the same period, owing to input cost escalation. Orient also started commercialization of their new R&D facility in Faridabad, which will give them a boost in innovative products.

Route Mobile Ltd

Route Mobile is a Communications Platform-as-a-Service (CPaaS) provider catering to Enterprise clients and Mobile Network Operators. The company’s revenues rose by 5.5% while net profit fell by -3.2% during Q1FY22. This is due to a decline in gross margins as Route Mobile lost some enterprise revenue.

The company also announced the acquisition of Sendclean from Sarv, which awards them the core-IP that would help them scale their email communications business. We believe that this will allow them to leverage existing customers through another touchpoint in the service cycle. Considering that email communication is a significantly higher-margin business, there remains a possibility of overall gross margins increasing as the mix changes.

Sumitomo Chemical India Private Limited

Sumitomo Chemical India Ltd. (SCIL) manufactures and markets products in the agri-chemical additives industry in India. In Q1FY22, the revenue and net profit grew by 21.1% and 33.1% respectively, over Q1FY21. This was aided by a 67% growth in their Herbicide product segment.

SCIL is also awaiting to get manufacturing contracts for supply to its Japanese parent company, Sumitomo Chemical Company, awaiting approval in-principle. The company has 5 molecules that are in the pipeline for commercialisation in the next 2-3 years which would bring in ~250 crores annually.

Syngene International Limited

Syngene is a pharmaceutical company that specialises in integrated research, development and manufacturing services on a contract basis. The company’s revenues in Q1FY22 fell by -10% over Q4FY21 but increased 38% over Q1FY21. As long-term investors, we prefer to look at topline growth over a larger period, which we believe will continue scaling at ~15% annually.

Over this quarter, the company got a contract renewal (until 2030) from Bristol Myers Squibbs with an additional investment of $10 million towards a dedicated R&D centre. Syngene’s new microbial facility is now fully operational and equipped with two fermenters (200L+500L capacity) to support large volumes in late-stage clinical trials. The company also has plans for a greenfield expansion in Mangalore to integrate manufacturing solutions on a commercial scale.

Tata Consumer Products Limited

Tata Consumer Products is an FMCG company focused exclusively on food and beverage brands. During Q1FY22, the company’s revenues grew 11% while net profit fell -38% from Q1FY21 levels driven by higher A&P brand investments in the India business during Q1FY22 and high inflation of tea prices.

In terms of volumes, their US Coffee segment de-grew by 16% over Q1FY21 while India foods saw 17% growth in volume. This fall was due to the impact of lockdowns, which saw reduced commercial consumption of beverages. Another product segment that stood out is premium salts which saw a 34% rise in revenue in Q1FY22 over the same quarter last year.

UTI Asset Management

UTI AMC is an asset management company that had been carved out of the erstwhile Unit Trust of India. The key driver of revenue is based on the assets they manage in their Mutual Fund, which grew 6% from Q4FY21 and 40% over Q1FY21.

UTI has the highest operational cost conversion (0.32%, as a percentage of AUM) among its competitors, primarily due to unionisation issues in the past. On this, we are optimistic that it is not likely to scale along with their AUM. The company has also gained SIP market share (3% in FY20 vs 5% in FY21) and is aggressive in promoting its MF through distribution networks. We believe this will help them scale their AUM at 20% on a conservative basis annually for the foreseeable future.

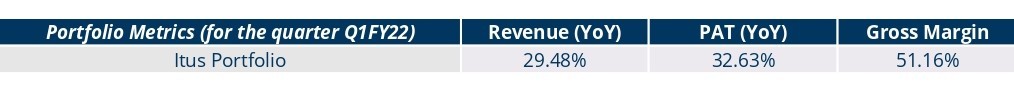

To summarise, the table below gives a snapshot of the growth of the portfolio. We would want investors to look at yearly trends alongside quarterly numbers to understand the growth from a slightly long-term perspective (P.S: Quarterly trends will always have an element of seasonality associated with the numbers).

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.