Reviewing Q1 FY23 at Itus (June 22 Numbers)

The quarter went by saw strong annual growth in revenue and profitability across our portfolio. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q1FY22 to Q1FY23, as compared to Q1FY21 to Q1FY22. This helps us track growth of our portfolio better, without overt dependence on cyclicality in the quarter.

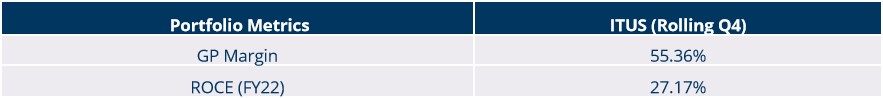

We also measure the health of the portfolio with the following metrics, that give us a summary of the earning capability of our holdings.

In our communication this quarter, we find it imperative to highlight a few themes that have a material impact on risk.

Consumer Discretionary:

As the Indian Economy continues to grow, discretionary spends by consumers will increase disproportionately. Looking at World Bank data and Ministry of Statistics (MOSPI) India data, discretionary spends contribute approximately 30% of GDP per capita (~$2,300) today. This spend is projected to contribute 40% by 2025 on a per capita basis, which assuming a ~7% growth rate on the GDP annually, would see an increase of ~74% in discretionary spending by 2026.

Fig 1: Disposable personal income of India over the last 25 years

With rise in disposable income, increased consumer spending, propensity to spend on discretionary retail (non-necessities like eating out, fashion, premium products etc.) increases. As India turns to its next phase of growth, consumer is a theme to watch closely. Companies that are able to grow/maintain gross margins while taking advantage of these macro trends will be large beneficiaries.

A few key segments that we wanted to highlight as beneficiaries of increased consumer spends:

Fig 2: Gross Margin % for top QSR chains in India

Fig 3: Per Capita footwear consumption in India vs. the World

Generic Pharmaceuticals – Gross Margin Contraction (Update):

In our communication two quarters ago, we spoke about how Indian pharmaceutical manufacturers are heavily reliant on China for API (active pharmaceutical ingredients) or KSM (key starting materials) procurement. As a result, the generic pharmaceuticals industry had started to notice an increase in input costs, as cost of imported APIs and excipients, as well as transportation and packaging materials, were already rising in the industry for the last 12-24 months, which along with supply crunch caused by China’s power crisis exacerbate the pricing of the industry.

We continue to see the effects of this in the quarterly gross margin, as the situation on the ground eases. To highlight this, Sandeep Singh (MD, Alkem Labs) spoke about easing of prices of key APIs from China, during the Q1FY23 management concall:

“Actually, prices of APIs [from China] started softening and as far as high-priced raw material consumption is concerned, I think more or less substantial part we have consumed, and we’ll start getting a little bit softened raw material price consumption going forward.”

On the one hand, our portfolio companies are growing their top-line aggressively, though this has come at the cost of a drop in Gross Margin (Varying between 1-3%). We expect the market share the companies we own gain during this period, result in significant operational leverage post the normalization phases over the next 4-6 quarters.

In the second hand (companies we do not own), we are seeing significant margin erosion along with lukewarm growth as the companies have production bottlenecks and are not completely reliant on China for their raw materials. We expect these companies to continue to struggle in this phase.

On the other front, IPM data for FY22, revealed robust growth in prescription sales value of the overall industry (14.6% growth) with Acute generics growing 19.8% in the period (for the portfolio companies we own).

Fig 4: FY22 growth sales value of prescription

At Itus, our positioning of the portfolio has been to account for the businesses with the ability to either pass on the prices to the end consumer (focused on branded generics) or those manufacturing molecules where they have a less of an import reliance on China. This has helped managed the downside experienced across a range of pharma companies.

Hospitals: Capex Cycle and Core Outlook:

Hospitals, in general, are a very-high fixed cost business, with building and construction costs, expensive medical equipment and surgical devices. Essentially, having low variable costs mean that these businesses will see significant operating leverage they during a period of recovery and revenue expansion as capital expenditure on facilities mature.

Hospitals measure a few key metrics that help us measure their growth and health:

Coming out of the Covid-19 pandemic, single / focused-multi specialty hospitals have been a key beneficiary of normalizing occupancy rates – as diagnostic testing for chronic and general illnesses increase back to pre-pandemic levels.

The following is an excerpt of Dr. Ramesh (MD, Rainbow Children’s Medicare) during their Q4FY22 concall highlighting how reaching maturity helps their profitability.

“In terms of utilization, we as a children’s hospital and perinatal services, … our occupancies about in a steady state in the normal year was about 56% in 2020. We expect to go, cross over 50% this year in a blended occupancy. … so, in a mature state like in Hyderabad where we can we reach up to 70%-72% of occupancies. So, when we do about 55% of occupancy, we do extremely very high revenue as well as profitability. That’s how trajectory we are looking at it.”

As a hospital’s new beds Capex materializes and gets to a stage of maturity, their increased occupancy would result in higher Fixed Asset Turnover, allowing for faster breakeven on Capex.

Fig 5: Net Fixed Asset Turnover for Rainbow Children’s Medicare

A higher/increasing Net Fixed Assets Turnover for any business that runs on fixed assets is a tell-tale sign of monetization efficiency on the topline. When paired with operating leverage that a hospital would gain, This would in turn flow though to the bottomline.

Fig 6: Net Fixed Asset Turnover for top Hospital Chains (listed)

A key dynamic that results in a varied NFAT for hospitals are the capex cost per bed. A typical multi-speciality hospital runs at a capex cost of ~1.2 crores per bed in a leased model, and ~2cr per bed in a fully owned model. In a focused speciality, the capex costs per bed is lower given the limited requirements of equipments. Key standouts are Apollo Hospitals and Rainbow Medical, who are able to manage a higher revenue per bed (ARPOB) while maintaining the dynamic of lower capex costs, resulting in higher efficiency and increasing margins.

In the next section, we briefly cover the investment changes made in the portfolio alongside the rationale for each.

Investment Changes

This past quarter we made a few changes to our investments. We shall highlight our reasoning and thesis for our decisions.

RACL Geartech (Buy):

RACL Geartech is an auto-ancillary manufacturing precision gears and related parts for 2-Wheeler, 3-Wheeler, Agriculture Equipment and recreational vehicles.

The company has a strong value-added manufacturing business on the back of low-volume & high-value products for high-end vehicles of customers like BMW, KTM, Kawasaki, Kubota etc., with roughly 70% of RACL’s business export-oriented. Since RACL operates in a high-customization, high-precision model, it maintains a large SKU (>500) and all manufacturing processes to its customers. This has allowed the company to generate Strong Margins, High ROCE and maintain High Client Stickiness.

To give a perspective of this, here is a Q2FY22 concall snippet from Mr. Gursharan Singh (MD):

“When we are to produce say, 800 different parts, it’s not that all 800 kinds of parts I’m producing every month. Some month, we are producing 100 components of X variety, the next month again 100 pieces of X/Y/Z variety. So, I have to maintain certain minimum inventory levels of our raw material and WIP as in the Premium segment and the volumes are not very high. We have 20 active customers, with totally different brands so eventually we have a large variety of products, so we have to keep inventories of the tooling and raw material, but our product costing is built in all this and we are charging the same from the customer.”

The company’s EBITDA margins have grown from 13% in 2017 to 24% today and this has allowed the ROCE to expand to 22%. The company has invested nearly Rs.100 crores in capex over FY21-FY22 combined. This capex is backed by firm customer orders and provides good visibility on growth ahead.

With the new capex going live, we expect two aspects to kick in:

UTI Asset Management Company (Sell):

UTI Asset Management, carved out of the erstwhile Unit Trust of India, manages the UTI Mutual Fund and provides portfolio management services to institutional clients and HNIs. Furthermore, it also manages retirement funds (UTI Retirement Services), offshore funds (UTI International) and alternative investment funds.

Our thesis around UTI AMC was based on two core focal points:

Fig 7: Key Financials as % of Assets under Management for Mutual Funds (FY22)

Looking at the above table tells us that UTI AMC had over 2x of operating expenses as HDFC AMC, who had managed their operating costs very efficiently. During the Q4FY22 results, however, it became evident that an increase in expense was a deviation from the core thesis. (667 crores in FY22 vs. 597 crores in FY21)

Additionally, the MF industry on the whole was facing yield compression in the equity book across the industry. This led to a potential further decline in profitability if the condition prolonged.

The expected a follow through on the expense reduction did not come through in FY22 despite an increase in the voluntary retirement for Senior level employees in UTI AMC over FY21. An increase in expense was a deviation from the core thesis, as this affected the core RoCE of the business (one of the core thesis of the investment was a risk)

We believed it prudent to exit the position after the Q4FY22 Earnings results.

To summarise, here is the health of our portfolio as of Q1FY23 (with the snapshot as of June 2022)

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.