Reviewing Q3 FY24 at Itus (Dec 23 Earnings Quarter)

We had ended FY23 (March 2023) earnings season, with a robust earnings growth translating into a stronger Cash flow growth in our portfolio companies. One of the characteristics that defined the portfolio was operating leverage playing out in the next cycle, as the capex our portfolio companies was deploying on the ground, was funded through internal accruals and the demand cycle being strong, meant that the cash conversion cycle was lower than the 10Y average we had seen.

We had anticipated FY24 to be a year of a relatively muted (lower than prior year) topline growth, offset by better Cash flow growth.

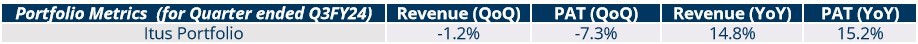

The quarter went by (Dec 23 – Q3FY24) saw strong annual growth in revenue and profitability across our portfolio. While QoQ growth is seasonality driven, on a YoY basis, our profitability margins grew along with robust revenue growth. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q3FY23 to Q3FY24, as compared to Q3FY22 to Q3FY23. This helps us track growth of our portfolio better, removing dependence on cyclicality in the quarter. Our portfolio companies continue to demonstrate healthy growth and profitability.

We also measure the health of the portfolio with the following metrics, that give us a summary of the earning capability of our holdings.

Below we highlight a few themes we saw this quarter:

Pharmaceuticals (Healthcare):

To understand how we position, it is imperative to gain an understanding the events that that transpired through cycles in an industry.

During the previous cycle in FY10-16, the primary lever for growth in US-focused generics, were from an influx of drug additions that were patent-expiry driven. Additionally, there were fewer generic manufacturers in the US and regulatory compliance norms by the USFDA were less stringent, making it conducive environment for Indian manufacturers to enter and scale their portfolios.

Exhibit 1: ANDA approvals by USFDA towards India-manufactured generics (2005-16)

In the last 8 years, US-focused generic formulation manufacturers have faced a period of pain. Consolidation of Group Purchasing Organisations (GPOs) – [consortium of hospitals, insurance providers and pharmacy chains, large distributors] into 4 major GPOs in the US has led to a price led-buying, reducing revenue per prescription for manufacturers.

Exhibit 2: Top Generic Drugs Price Trend in the US (2016-22)

This has led to several US-operated plants and generic companies to go bankrupt or shut down several of its plants (Example, Akorn Pharma filed for bankruptcy and took their products off shelves; Companies like Teva have shut down several US plants.) EBITDA Margins for top generic manufacturers have declined in the last 6Y.

Exhibit 3: Closeout Rates for Warning Letters by US-FDA (2018-22)

The reduced scope of feasibility leading to decreased competition, combined with poor USFDA compliance from generic units have led to shortage of drug supply in the US. While this is a sign of positivity for US-focused generic drug manufacturers, the dynamics of the business have not entirely shifted out of favour from GPOs.

However, the above factors have led to an environment with relatively lower price erosion, that is expected to last for atleast the next 4 quarters. Today, we are keen, to pick select generic manufacturers that are among the largest operating in the US with a clean track-record in compliance, while simultaneously growing their drug portfolio – measurable through drug approval filings with the USFDA.

Energy: Oil & Gas:

India, with its growing economy and population, faces a dynamic landscape in terms of power consumption and generation. We find it necessary to pinpoint what we have seen through data that have shaped our investments in the power sector. Between 2007 and 2017, the increase of capacity kept pace with the annual growth in demand for energy at about 8%. The government’s target to reduce emissions and reach renewable capacity to 500 GW by 2030 have come at the expense of minimal thermal power capacity expansion since 2017.

Aside from road transportation, Crude and Natural Gas are primarily used for industrial power generation, petrochemicals, steel and fertilizer industries. Roughly ~55% of overall gas volume in India cater to power generation. Roughly 84% of Natural Gas produced in India is from ONGC/Oil India. Production had not increased in the last 10 years, and as a result transmission volumes were stagnant.

Exhibit 4: Natural Gas Production Volumes in India (2014-23)

Consequently, consumption growth has surpassed capacity addition, resulting in shortages during periods of high demand. To elucidate, February 2023 had a 9 GW shortfall in produced electricity vs demand.

Exhibit 5: Installed Power Generation Capacity in India and growth

Exhibit 6: Power Consumption Growth in India in last 20Y

The pace of renewable power capex has not picked up significantly to match the demand. Today, Solar is only 7% of installed power capacity in India. This has led to thermal plant load factor increasing from ~57% in 2018 to ~68% in 2023.

For the first time in the last 10 years, we are seeing meaningful gas field discoveries in India, which should lead to transmission growth. Additionally, in order to cut carbon emissions, the government has taken stance on targeting the share of natural gas in India’s energy consumption to 15% by 2030 from 6.3%, currently.

Our investment in GAIL (which controls ~70% of India’s Natural Gas pipelines) is an extension of the trend we highlighted above, and is supported by commencement of new pipelines that is expected to commence in the next 2-3 years. Incremental increase in natural gas production and consumption volume in India, would necessarily be beneficiary to GAIL. In addition to gas pipeline volumes, capacity addition on their petrochemicals segment would start to get utilised, resulting in potential margin growth as well.

Auto & Auto Components: 2W Volumes:

Within the Automotive space, a key facet we were noticing based on data on the ground, are 2-Wheeler volumes.

While the 2W volumes over the last decade has moderated and just seen 2.4% CAGR growth, the 2W demand shifted from sub-125cc motorcycles to scooters and premium 125cc+ bikes over FY13-18. However, this trend reversed over FY19-22, as the rural economy held up better than urban for 2W, while the replacement cycle, in our view, got delayed amid Covid. The tide has turned again over the last two fiscal years driven by urbanization, premiumization and electrification.

Exhibit 7: Share of scooters and premium bikes to rise

Two-wheelers (2Ws) have lagged in recovery but the abnormal 35% fall over FY19-22 created a very favourable base for the segment that is core to personal mobility; we believe 2Ws are ripe for a replacement cycle too. And, if we observe the domestic registrations, Q3FY24 saw the highest volumes over the last 5 years. At Itus, our investments in two-wheeler OEM (Bajaj Auto) & related ancillary (Suprajit Engineering) are an extension of the same.

Exhibit 8: Domestic Two-wheeler registrations (source: VAHAN)

Exhibit 9: Average age of 2W’s vehicles on the road

Logistics & Ports:

The manufacturing sector has emerged as a key driver of export growth, fueled by various factors such as increasing competitiveness, improved production capabilities, and a conducive business environment. This surge in manufacturing exports highlights India’s ability to meet global demand for diverse products, ranging from automobiles and machinery to textiles and electronics. The sector’s robust growth not only enhances India’s export revenue but also strengthens its position as a global manufacturing hub. Therefore, ports form a key gateway to India’s EXIM market, and therein, act as a proxy to India’s economic story.

Given India’s large coastline (~7,500km), ports play a pivotal role in the country’s development by facilitating the export and import (EXIM) of goods. As per the Ministry of Shipping, 95% of the country’s international trade by volume and 68% by value is moved through maritime. To facilitate this, the country has 13 major ports and 205 notified minor ports – which handle aggregate traffic of 1,433mmt (FY23)

Exhibit 10: Volumes handled by the major ports in the country (FY10-23)

Over the past decade (FY13–23), cargo handled at India’s ports has steadily increased (4% CAGR), represented by a rise in the county’s GDP (real GDP: 5.5% CAGR) and EXIM. Notably, a large part of cargo handled is dominated by the Energy basket – 1) iron ore, 2) coal, and 3) petroleum, oil & lubricants (POL). Together, the three account for ~60% of handled cargo.

Exhibit 11: Correlation between GDP Growth and Port Volumes

The government is keen on improving India’s positioning with the advent of schemes such as Sagarmala, initiatives related to port modernization, and infrastructure development through freight corridors for better and faster connectivity to the hinterland. Further, the relaxation of cabotage restrictions, allowing foreign vessels to transport coastal cargo, has created a significant opportunity for higher trans-shipment volumes at ports in India.

To summarise, the below table gives an overview of the health of our portfolio as of Q3FY24 (with the snapshot as of December 2023)

Note: The sum of above weights would not total up to 100%; remaining would be our cash holdings.

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.