It’s a question we hear everyone around us ask, as investors panic looking at the free fall in the value of their existing investments. There are two problems with the question, in its current form: a) The assumption, that anyone has clarity on what the low is for the markets b) how does one define the market, as it is a basket of all listed companies in India which amounts to more than 5000 companies today.

While the last few weeks have seen multiple days of double-digit drawdowns in most stocks, traded on the exchange, we are in the midst of fear that has translated into a panic. Moreover, when momentum on the downside picks up, as it has in this environment, algorithmic traders add to this party by accentuating the selling.

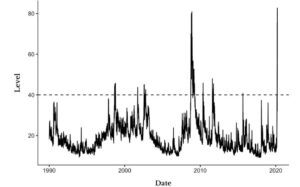

As a result of the increased fear and selling, the VIX Index (which is a measure of volatility) has recently made record highs, both globally and in India.

VIX Global Index Overtime

The above graph shows the levels of VIX during the last 30 years, with a threshold of 40, being an indicator of panic. Since we are looking at the VIX levels above, one needs to look at the benchmark index as price points to understand how it correlated during various periods of panic.

Source: Ycharts

Each of the spots marked in red is indicators where VIX crossed the psychological barrier of fear levels. While the returns over the course of the next 6 months post the time the fear levels were crossed, it was not always positive, in all instances, the market recovered above the level over the course of the next 1 year.

There certainly is no foolproof way to understand where the market bottom is, and neither are we trying to make a case for that. However, there is a strong case to be made for buying quality companies today, where there is widespread fear as shown by quantitative data above as well.

Though the data points for measuring volatility in India, do not date back for 30 years, the chart below shows the same fear level index in India at the moment.

INDIA VIX LEVEL vs TIME

In the current nature of markets, to provide an answer to the question – ‘Have we reached the bottom’, we would like to make a strong case of a sale being provided by the market, and we would be carefully selective in buying into the market leaders in this sale.

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.