In the first article we wrote about cycles, we spoke about why understanding cycles helps an investor position themselves better to manage risk and in-turn maximise risk-adjusted alpha. One of the core drivers of cycles continue to be earnings growth. While India, continues to be one of the strongest growth markets, to achieve growth over a 10-year period continues to be a rare feat for companies.

Considering the nominal growth in India continues to be low double digits (11-12%, post inflation), we took the threshold of companies in India who achieve a 10% bottom-line growth over periods of time.

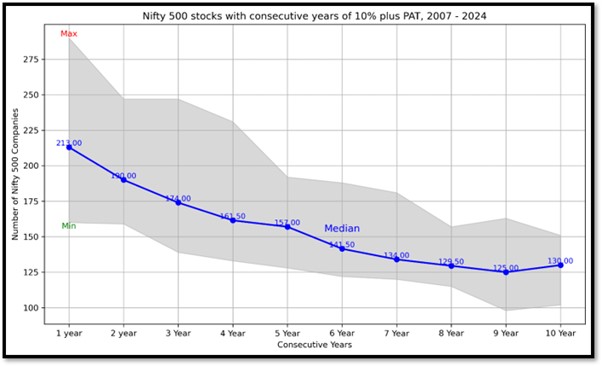

Fig 1: Rolling analysis of the number of companies who show 10% earnings growth over consecutive periods. (Blue line shows the median number of companies across 17 years of analysis).

As can be seen, as the longevity of consistency increases, the number of companies who manage to achieve this reduces significantly. More importantly, very few companies manage to achieve this across periods (this changes basis the cycles and which companies that have tailwinds from a sectoral perspective).

Earnings growth is not only dependent on the balance sheet but also on the external environment the business is operating in and the macro during the period. For example, the last decade (2010-21) globally was deflationary in nature which benefited technology and consumer as a sector. While technology tends to do well during deflationary periods, the market cap accretion predominantly happened from technology companies where the capital allocation was prudent (the cash flows generated were used to continuously buy back shares at a time where global Central banks were going through slow down and consequently rate cuts) in US. Similarly in India, the consumer facing companies and technology companies benefitted and grew their earnings. However, as we entered inflationary period, you the cycle changes and the businesses that grow their earnings tend to be a very different set of companies. Studying cycles in the Indian context across sectors shows the below.

Fig 2 : Sectoral performance in India across time

As humans, we tend to extrapolate existing conditions by giving a valuation number into the future basis current earnings today, which can result in significant drawdowns as the cycles change, and in-turn growth numbers get repriced. This also goes back to the adage of the concept of buy and hold, which in a world of active fund management, needs to be re-thought of. In investing, there is nothing that eternally works, since the environment is always changing, and investors’ efforts to respond to the environment cause it to change further. Hence, its becomes imperative to understand what drives earnings growth and follow them closely with the macro cycles that drive growth.

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.