The Genesis of Insurance dates back to 100BC and an ancient Roman belief that anyone who was not given a proper burial would return as an unhappy ghost, hence it was imperative to ensure that every single person who died was buried in the correct manner. Just as they do today, funerals cost money in ancient Rome. And in order to ensure that cost would not be a barrier to following proper burial protocol; Gaius Marius (a Roman military leader) started a “burial club” among his troops. They would each pay a small fee that would be held in a corpus for usage in an untimely event – the first documented instance of insurance.

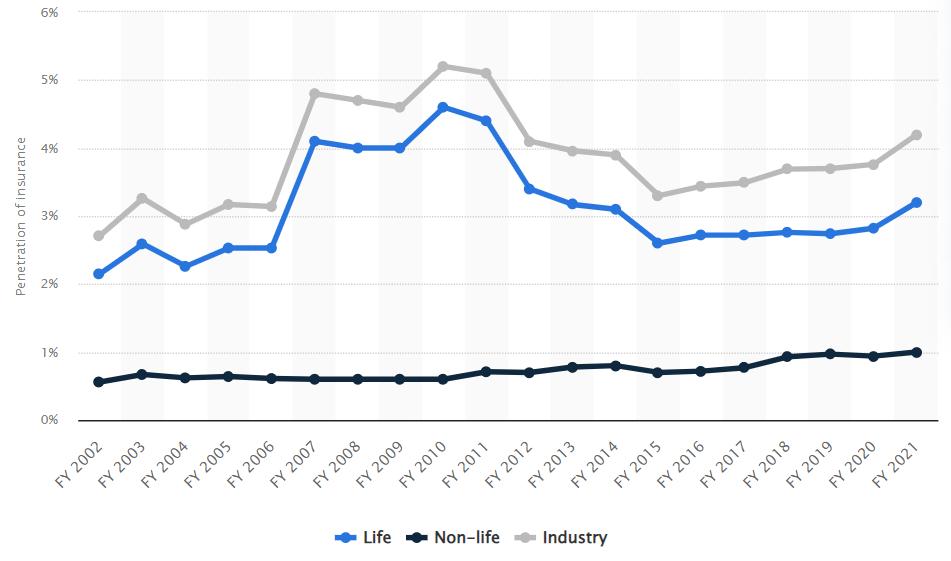

Globally, with thousands of insurance providers, Insurance penetration stands at 7% today. In India, however, that number is far lower at 3.2% for Life Insurance and 1% for Non-Life products. One can presume a few reasons that contribute to this disparity – with Indians having lower discretionary spend per capita than developed economies and general unawareness about the necessity of insurance in the country. The COVID-19 pandemic was a beneficiary to awareness of the consumer, and as the GDP per capita of India increases, Insurance as a sector will have tailwinds for growth over the next decade.

Fig 1: Insurance Penetration in India

The story of Life Insurance in India is a relatively recent one. In 1956, with an Ordinance issued, nationalising the Life Insurance sector and Life Insurance Corporation came into existence by absorbing 154 Indian, 16 non-Indian insurers as also 75 provident societies—245 Indian and foreign insurers in all. In August 2000, the IRDAI opened up the market in August 2000 with the invitation for application for registrations. Foreign companies were allowed ownership of up to 26%, enabling Joint Ventures – Standard Life & HDFC to create HDFC Life and Prudential Corp owns 22% of ICICI Prudential Life. Between 1956 to 2001, Life Insurance Corporation was a monopoly – which explains its market share and size today.

In order to distinguish themselves from LIC, the private players started offering a Unit-Linked Insurance Plan (ULIP) – a combination of insurance and investment pay-out. Boosted by the equity bull-run in the mid-2000s till the 2008 crisis, the industry’s total assets under management (AUM) have increased nearly 30 times from ₹1.5 trillion in 2000-01 to ₹44.79 trillion in 2020-21, as per IRDAI data. In 2008, ULIP contributed 60% of all products sold, which has reduced to 27% since – partly due to stricter regulations imposed upon Life Insurers. As a consequence, between 2008 to 2015, Life Insurance penetration declined from 4.6% to 2.8%, with the growth in penetration since moving from investment-based mindset towards protection-based insurance. Today, there are 23 Life Insurers in the private sector and LIC in the public sector in India with the industry growing at a ~11% CAGR growth on their premiums.

Consistency in Growth & Focus:

On an operational basis, however, not all Life Insurers are on par. A few commonly used metrics to differentiate Life Insurers are, growth in Annualised Premium Equivalent (APE) and Value of New Business (VNB) – that measure the present value of future profits for new policies written in that year. In terms of APE growth, HDFC Life was the most consistent of the insurers – growing at 18.1% CAGR, followed by SBI Life, which grew at 16.9% CAGR. While premium growth is imperative, it paints only one side of the story. We would then need to look at operational metrics.

Table 1: Annualised Premium Equivalent (APE) growth for top Life Insurers

Every insurance company, by virtue of design, would have their costs front-ended. Consumer acquisition – marketing, commissions and underwriting expenses would make up the bulk of any insurer’s expenses towards a written policy over its lifetime. Therefore, the Persistency Ratios are an important metric that tells us the retention of a policy by its holder over the years. Increasing or higher Persistency also helps qualitatively identify increased customer satisfaction and stickiness towards the insurer. As most costs are upfront, if a Life Insurance business were to retain a higher percentage of policies, they would generate more revenue over the years on a given policy underwritten – which should translate directly to their bottom line.

Fig 2: Persistency Ratios of top Life Insurers

A culture of customer-centric approach, runs deep in HDFC Life. Vibha Padalkar (MD & CEO – HDFC Life) joined the company in 2008, and was integral in building the culture of the firm as the CFO before taking over in 2019 as the MD and CEO of HDFC Life. Prior to HDFC Life, Vibha has a background in Business Process Management and International Audit. Since her taking over in 2019, the company have actively invested into technology to make multiple automated touchpoints for servicing clients and increasing transparency in policy disbursals. The results of these same has been reflected off increasing persistency ratios. (13th and 61st month persistency ratios in FY19 were 87.2% and 52.3%, increasing to 91.7% and 58.1% respectively by FY22)

Over the last 3 years, HDFC Life has also taken a keen focus towards reducing its dependency on ULIP products, which typically have lower profitability (VNB Margins). The company was able to reduce it from 45.7% in FY19 to 22.4% in FY22, contributing to improving VNB margins from 22.6% to 28.4% during the same period.

Fig 3: ULIP (unit-linked) as a percentage of APE (HDFC Life)

In the mid-2000s, the private sector was focused on agency channels (as did LIC), which was the primary channel through which Insurance policies were sold. Over time, private Life Insurers have de-levered into direct and bancassurance channels, which typically have lower commissions (direct having minimal costs or commissions). As of FY22, HDFC Life had the highest direct contribution to its channel mix at ~36% of their VNB, compared to 27% for SBI Life and other insurers in the range of 15-25%.

Translating Consistency to Profitability

Value of New Business (VNB) Margin is among the most important metrics that an investor should track towards picking the right life insurer. It is a measure of profitability of all new business written during the year. As evident, due to HDFC Life’s ability to focus on consistent growth while improving industry-leading client retention, it has been able to translate the same towards increased profitability in comparison to its peers. Other players, while improving their VNB Margins, fall well below HDFC Life consistently, which stands highest in Industry today at 28.4%.

Fig 4: VNB Margins for top Life Insurers (listed)

Additionally, any insurance company has the opportunity to make money through two modes. Typically, their revenues (premiums) are upfront with a time-gap before a claim occurs. Insurers use this advantage and invest this capital in securities. In India, for example, the yield on an insurer’s AUM book (with restrictions by IRDAI) has been at low-double digits in the past during higher interest rate environments and at high single-digit yield today.

A Valuation Framework

While the bulk of the expenses of a life insurer are upfront, the premiums made are staggered over the course of the next several years, depending upon the term and length of the product. Therefore, it makes a great deal of sense to look at valuing Life Insurers on the basis of Value of New Business (VNB) – that indicates the total value of future profits from policies written in the year. To do the same, we have compared the gross VNB multiples they trade at – with HDFC being richly valued by virtue of its best-in-class metrics.

Table 2: VNB Multiples of top Life Insurance companies (listed)

Since VNB earned during a year bears a resemblance to Cash Flows for life insurers, projecting a VNB similar to cash flows in a DCF analysis, gives us an expected IRR between high-teens to mid-20s for HDFC Life.

At Itus, our thesis on HDFC Life takes comfort from the fact that the company continues to have a focused approach and improve on its Persistency Ratio while maintaining an APE Mix that optimises VNB Margin (indicator of future profitability for any life insurer). Consistent growth in premiums and a core focus on improving profitability and customer centricity are key to our thesis towards HDFC Life. With increased awareness on the benefits of insurance and rising discretionary spend as a result of an upward trend in GDP per capita, India is bound to see a tailwind for the insurance industry over the next decade.

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.