Since October 2024, the Indian stock market has been experiencing a correction. The Nifty 50 index has dropped by over 15%, while small- and mid-cap indices have seen even steeper declines of 20–25%. What should we do if we invested at the market peak and don’t have additional capital to average out our positions? Should we accept the loss, exit the stock market, and consider investing in other assets like gold?

Let’s examine historical data for guidance

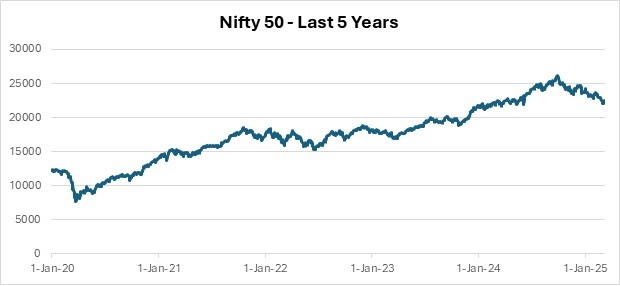

Nifty Recent History:

Over the last five years, the most significant market fall was during the COVID-19 crash (Nifty dropped by 38% from its previous high). Suppose someone had made a one-time investment in January 2020, when Nifty was at its peak. What happened next?

During the 2020 COVID-19 crash, markets dropped by 38.3%. However, they recovered, delivering an annualized return of 12.39% from that trough until now. The ITUS fund performed even better, providing returns of 15.44%. If someone had panicked and booked their losses after two to three months at an average 25% loss, then reinvested that amount in gold, their compounded annual growth rate (CAGR) would have been only 9.09%—even after Nifty’s recent 15% decline and gold’s 15% rise.

Key Takeaway – Market downturns are temporary, but long-term growth remains consistent. Additionally, if you invest more capital during a downturn, it can significantly boost your returns.

Stay invested!

We have written about how investing in volatile market can benefit your overall returns of the portfolio. You can read about it in the below link –

Series 96 – Market Cycles and Investing Strategy – ITUS Capital

Keep following us for more contents like these. As always, we keep re-emphasising our SIP mode of investment. You can connect with your relationship manage to know more about our SIP Program.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital