In our previous episode, we explained a unique aspect of our portfolio and the importance of Capital Calls to our investors. This week, we want to emphasize the significance of benchmarking and how it pertains to our investment approach. We had discussed this during our quarterly call.

WHAT DOES BENCHMARK MEAN TO US –

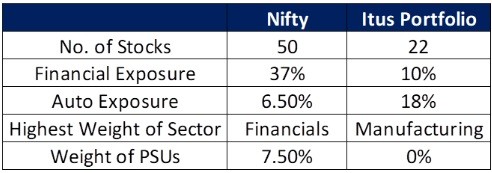

To illustrate, we have provided a breakdown of the number of stocks and their respective weights for major themes in both the Nifty 50 and our portfolio. As we can see, our portfolio has an 18% exposure to the auto sector, with investments done in auto ancillary companies. We will continue to be overweight in Auto Sector. In contrast, the Nifty 50 has a higher weightage in the financial sector, whereas our portfolio is primarily invested in B2B manufacturing companies. It is worth noting that we have not invested in any PSU’s

By providing this information, we aim to convey the following points:

We trust that these information is beneficial in presenting our fund to clients.

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital

As a part of our ongoing commitment to keeping you informed, we remain dedicated to our SIP program, providing investors with a convenient avenue to regularly enhance their portfolios. We encourage you to explore the benefits of this program for your clients. If you require more details, please don’t hesitate to reach out to your dedicated relationship manager at [email protected].