In our four distinct stages of portfolio construction and evaluating business, the first stage is BUYING. This week we decided to elaborate on our Buying process.

A business can grow in many ways, such as through revenue growth, EBITDA growth, or earnings growth. However, we are more interested in how much of this growth is translated into cash flow, and whether the business can reinvest this cash flow to generate returns that exceed the cost of capital. Very few businesses have this ability, and we are willing to buy them in our portfolio for long term if we find them.

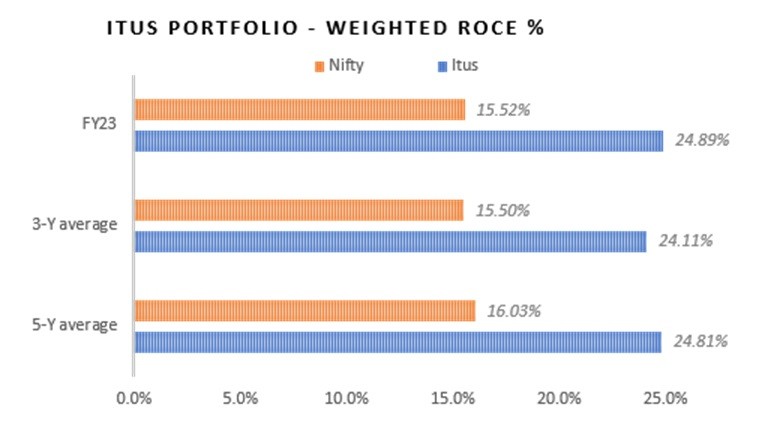

Although short-term market volatility is a normal part of investment journey, our returns are driven by businesses that generate cash flow and reinvest it for growth. We measure the health of our portfolio by tracking these metrics. The chart below shows that over last 5 years our portfolio has consistently outperformed the market due to its higher return on capital employed (ROCE). When this ROCE is reinvested in the underlying businesses, it generates significant cash flow growth over long term. A focus on BUYING businesses with high or rising ROCE and reinvestment in the business leads to high Cash Flow Growth in the long run which will align to the portfolio returns.

We will discuss the second stage of portfolio construction, which is EXPOSURE, next week. In the meantime, we wish you a happy weekend.

If you like to read the entire episodes of our “Weekly Enlightenment” please click the link below:

Weekly Enlightenment Archives – ITUS Capital

As a part of our ongoing commitment to keeping you informed, we remain dedicated to our SIP program, providing investors with a convenient avenue to regularly enhance their portfolios. We encourage you to explore the benefits of this program for your clients. If you require more details, please don’t hesitate to reach out to your dedicated relationship manager at [email protected].