Reviewing Q2 FY22 at Itus

The quarter went by saw strong growth in revenue and profitability across our portfolio. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q2FY21 to Q2FY22, as compared to Q2FY20 to Q2FY21. This helps us track the growth of our portfolio better, without overt dependence on cyclicality in the quarter.

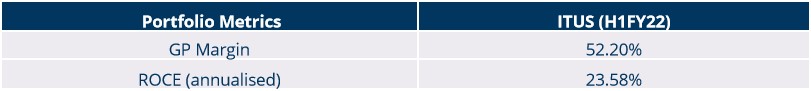

We also measure the health of the portfolio with the following metrics, that give us a summary of the earning capability of our holdings.

In our communication this quarter, we find it imperative to highlight a theme that has been building up over the last 6 months.

Raw Material Inflation – here to stay?

A common theme among management commentary over the last two quarters is that pan-industry, commodity and raw material prices have soared at an unprecedented pace. Manufacturers must either absorb increased costs, find new ways to offset expenses or pass price hikes on to customers who are careful to absorb the higher price. This comes as no surprise – Unanticipated hurdles have upset global supply chains, making it tough for manufacturers to stay in the black, from rising energy costs and freight container shortages to unexpected variations in raw material costs.

The following quote is an excerpt from the Galaxy Surfactants Q1FY22 earnings call, made by Mr. U. Shekhar, managing director of the company.

“Rising input costs and unavailability of certain critical raw materials adversely impacted our ability to service demand, thereby impacting our performance. Ladies and gentlemen, we may sound pessimistic, but we think it is important to convey to you the reality as it is. The international logistics scenario continues to worsen, and we see the same continuing for the remaining part of the year.”

Many industries temporarily shuttered at the start of the covid pandemic in early 2020, interrupting output and forcing a large amount of cargo to be blocked at ports. Carriers also saw this as an opportunity to transfer a portion of their fleet to refurbishment yards to stabilize/reduce expenses and the erosion of ocean rates. This not only slowed import and export, but it also meant that many empty containers were not picked up. However, the saga regarding container shortages stems from the container manufacturing industry’s poor financial performance in 2018, leading to some container producers shuttering operations. Since 2018, there has been a decline in containers produced yearly, while a build-up of older containers led to a net decrease in containers last year.

Figure 1: Container production + scrappage

Another important dynamic of the container shipping industry is that there is an imbalance in major transit routes. For example, North America currently faces a 40% imbalance, which means that for every 100 containers that arrive only 40 are exported. 60 out of every 100 containers continue to accumulate. The pressure is on to get containers back as soon as possible to Asia so that carriers can take advantage of these margins, empty or full.

Hapag-Lloyd’s senior director of corporate communication Nils Haupt highlighted this shortage –

“We are desperately looking for more capacity, we are asking our customers to return empty containers earlier. We looked at containers that are currently in repair or ones which are meant to be sold because they have reached a certain age.”

Given the high demand and the supply shortage, the cost of freight from China and East Asia to Northern Europe and North America have risen 7 times since the beginning of 2020. Not only does this exacerbate raw material price inflation, but also puts at risk companies that are reliant on global supply chains. These pricing increases will eventually be passed down to consumers – at the risk of tapering demand. However, it is important to note that such surges in container pricing should normalize over the next 2-3 quarters, as evidenced by ~20% decrease in container pricing in a span of three weeks. (Supply-side distortions generally are temporary headwinds for a business unless the change is structural – which is not our base case).

Figure 2: Freightos Baltic Index (FBX) Global Container Index

An unexpected boost in international trade volume was caused by early coronavirus recovery in Asia and exploding demand in all markets. Though exacerbated by bottlenecks in ports and truck capacity availability, there were also a few pockets that witnessed severe commodity price inflation. Among them, a shortage in polymer additives caused by maintenance delays and natural disasters that led to a reduced resin production.

Commodity price volatility may not be a one-time occurrence, as the supply of various raw commodities become more difficult to get. For example, iron ore, which is the primary component of steel, has a global supply expected to last 500 years and is geographically diverse. However, as the extraction of these resources becomes more complex, geological availability is no longer the only factor to consider – soaring exploration costs, labor price hikes due to global skills shortages, government-mining regulations, and transportation are just a few of the challenges in bringing these raw materials into supply.

In moments like these, it is all the more important to be disciplined around the kind of business we own and minimize risks where we see them. A crucial aspect we search for – is a company’s capacity to raise prices over inflation without affecting sales or losing existing clients. Typically, pricing power might be present in companies where product demand is constantly increasing and price increases are unavoidable to the consumer, or for which there is no perfect substitute. To illustrate – Balkrishna Industries manufactures off-the-road tyres for agricultural and industrial sectors. At the time of writing this, there is growing demand (that exceeds supply) due to essential modernisation, allowing the company to pass on increased costs. Another tell-tale sign is when a business has a monopoly and the barrier to entry for newcomers is high. Indian Energy Exchange is prime example with 96% market share in the short-term power market.

At Itus, we ensure that the businesses we own are capable of the above, especially in times of risks in the system increases. In an excerpt from the CERA Sanitaryware’s Q2FY22 earnings call, the management acknowledged that inflation in raw material prices has forced them to hike their product pricing.

“There have also been price increases in some of the ancillary cost items like transportation cost and packaging. The cost of corrugated boxes has gone up by 15%, which will be effective from Q3 onwards…

Sanitary ware vendors too have been provided a price hike as the cost of gas and labor has moved up. The range of change effective October and November 2021 will be 8.5% and 9% for Sanitaryware vendors, and around 5% to 6% for Faucetware vendors.”

At this point, it appears that inflation – both on the raw materials and the consumer-end will continue to be a factor over multiple quarters to years. We find it highly consequential to ensure that we are aware of the underlying risks that might surface if the businesses we hold are not capable of maintaining market share or pricing power. Its important that the businesses we own are maintaining their gross margins alongside ensuring the return on capital generated does not drop (preferably go up over time). These trends strengthen the balance sheet of the businesses and ensure that they continue to gain market share from competition as demand picks up on the ground.

Our portfolio companies, continue to show strong trends towards improved margins during a time when the margin pressure across industries have been evident. While some of the portfolio companies have chosen not to take price increases this quarter, we expect them to come through over the next few quarters.

Investment Changes

This past quarter we made one new investment. We shall highlight our reasoning and thesis for our decisions.

Nazara Technologies:

Nazara Technologies operates a diversified gaming and e-sports company that purchases controlling stakes in gaming and its auxiliary spaces companies, to build a strong value chain for its services. The company’s three primary focuses are gamified learning (Kiddopia) targeted to 2 to 7-year-old children, E-sports (Nodwin) which hosts national and international level tournaments for popular games like PUBG and Valorant, and real-money gaming (through OpenPlay).

Of these, it is our belief that the e-sports segment has the largest potential, in a nascent and fast-growing industry – with Nodwin leading market share in the Indian sub-continent, as well as operating in a few geographies worldwide. E-sports manages to uniquely and interactively engage fans of each videogame to participate in grassroot tournaments and view the best of competitors on a national and international stage. The primary sources for Nodwin’s revenue – broadcasting fees and sponsored advertisements are expected to scale at ~40% annually as viewership picks up. On other aspects of their business, Nazara Technologies has acquired several live event IPs and invested in digital media companies and is expected to benefit from the synergies it derives.

To summarise, here is the health of our portfolio as of Q2FY22.

Team Itus

Disclaimer:The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.