Reviewing Q2 FY24 at Itus (Sep 23 Earnings Quarter)

We had ended FY23 (March 2023) earnings season, with a robust earnings growth translating into a stronger Cash flow growth in our portfolio companies. One of the characteristics that defined the portfolio was operating leverage playing out in the next cycle, as the capex our portfolio companies was deploying on the ground, was funded through internal accruals and the demand cycle being strong, meant that the cash conversion cycle was lower than the 10Y average we had seen.

We had anticipated FY24 to be a year of a relatively muted (lower than prior year) topline growth, offset by better Cash flow growth.

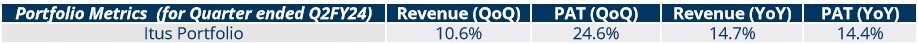

The quarter went by (Sep 23 – Q2FY24) saw strong annual growth in revenue and profitability across our portfolio. The revenue growth was higher on a QoQ basis, which was in line with our expectation, the profitability continued to improve. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q2FY23 to Q2FY24, as compared to Q2FY22 to Q2FY23. This helps us track growth of our portfolio better, removing dependence on cyclicality in the quarter. Our portfolio companies continue to demonstrate healthy growth and profitability.

We also measure the health of the portfolio with the following metrics, that give us a summary of the earning capability of our holdings.

Below we highlight a few themes we saw this quarter:

Construction and Realty:

Realty as a sector is characterised by higher project costs, long project duration and higher regulatory norms. Hence, Real estate developers often use debt financing to leverage their investments and can increase the scale of their projects and to generate greater profits.

During the 2006-10 cycle, the balance sheets of most top developers was highly leveraged. This coupled with the economic slowdown (post 2008 financial crisis) & oversupply of properties in major markets (ex: Delhi-NCR, Mumbai) met with muted demand, meant that the developers were hit with increased interest cost payments which were not met with their EBITDA they generated.

Over the last decade, we saw two big trends – consolidation on the supply side, delivering of the balance sheets that survived and increased regulation which favoured the brands.

Exhibit 1: Comparison of the debt profile of largest developers between 2006-10 & 2020-23

Exhibit 2: Consolidation of RE developers over the last decade

However, today the scenario is different. Most of these companies today are expanding on the back of de-levered and heathy balance sheets. There is an increasing supply of new launches in the country, with strong sales. While we did not own the developers in the cycle as a part of the portfolio, we had positions in real estate ancillary businesses such as Cera Sanitaryware & Kajaria Ceramics which benefits from the downstream applications of the real estate.

Exhibit 3: Increasing supply of new launches in the country

Auto & Auto Components:

While the 2W volumes over the last decade has moderated and just seen 2.4% CAGR growth, the 2W demand shifted from sub-125cc motorcycles to scooters and premium 125cc+ bikes over FY13-18; however, this trend reversed over FY19-22 as the rural economy held up better than urban for 2W, while the replacement cycle, in our view, got delayed amid Covid. The tide has turned again over the last two fiscal years FY22 & FY23 driven by urbanization, premiumization and electrification.

Exhibit 4: 2W Registrations over the last decade in India

Exhibit 5: – Share of scooters and premium bikes to rise

Similarly, in the passenger vehicle segment, we can observe that the share of SUVs is up from 21% in FY14 to 52% in FY23.

To highlight, we hold companies with leading market share in passenger vehicle segment (Maruti) and ancillaries like which make powertrain and transmission components for PVs & EVs. (Divgi TorqTransfer systems). We also have global automotive cable manufacturer (Suprajit) as well as a precision gears and shaft manufacturer that caters to the higher-end 2W market (RACL Geartech).

Additionally, we also we hold companies that make engine and chassis components that cater to M&HCV and Industrial vehicles (Craftsman, Bosch) and benefitted from the recovery in the trucks and commercial vehicles cycle. We continue to position ourselves in pockets where we see a core process engineering-based volume growth in our portfolio companies and where the companies have a sticky relationship with the end-clients and can protect/pass on margins (depending on the value-addition they provide in the supply chain).

Exhibit 6: M&HCV Truck volumes over the last decade

Power:

India, with its growing economy and population, faces a dynamic landscape in terms of power consumption and generation. We find it necessary to pinpoint what we have seen through data that have shaped our investments in the power sector. Between 2007 and 2017, the increase of capacity kept pace with the annual growth in demand for energy at about 8%. The government’s target to reduce emissions and reach renewable capacity to 500 GW by 2030 have come at the expense of minimal thermal power capacity expansion since 2017.

As a result, consumption growth has surpassed capacity addition, resulting in shortages during periods of high demand. To elucidate, February 2023 had a 9 GW shortfall in produced electricity vs demand.

Exhibit 7: Installed Power Generation Capacity in India and growth

Exhibit 8: Power Consumption Growth in India in last 20Y

The pace of renewable power capex has not picked up significantly to match the demand. Today, Solar is only 7% of installed power capacity in India. This has led to thermal plant load factor increasing from ~57% in 2018 to ~68% in 2023.

Exhibit 9: Power Consumption Growth in India in last 20Y

Our investment in NTPC is an extension of the trend we highlighted in the power sector and is supported by new capacity expansion in the thermal and renewable energy that is ongoing/expected. Furthermore, as grid and power infrastructure investments in India are rising, we position ourselves in pockets where we see pricing power and margin protection. At Itus, we have an investment in ABB India, which provides electrical components that are crucial for the development of the power sector.

Healthcare:

In the last 8 years, US-focused generic formulation manufacturers have faced a period of pain. Consolidation of Group Purchasing Organisations (GPOs) – [consortium of hospitals, insurance providers and pharmacy chains, large distributors] into 4 major GPOs in the US has led to a price led-buying, reducing revenue per prescription for manufacturers.

Exhibit 10: Top Generic Drugs Price Trend in the US (2016-22)

This has led to several US-operated plants and generic companies to go bankrupt or shut down several of its plants (Example, Akorn Pharma filed for bankruptcy and took their products off shelves; Companies like Teva have shut down several US plants.) EBITDA Margins for top generic manufacturers have declined in the last 6Y.

Exhibit 11: Closeout Rates for Warning Letters by US-FDA (2018-22)

The reduced scope of feasibility leading to decreased competition, combined with poor USFDA compliance from generic units have led to shortage of drug supply in the US. While this is a sign of positivity for US-focused generic drug manufacturers, we remain cautious on the optimism – since the dynamics of the business have not shifted out of favour from GPOs.

Within Healthcare, another focus point where we at Itus, are invested in, are Hospitals – through our investment in Rainbow Children’s Medicare. We have previously written about the nature of the industry, driven by high-fixed cost investments and low variable costs – mean that these businesses will see significant operating leverage they during a period of recovery and revenue expansion as capital expenditure on facilities mature.

Over the last 1 years, hospitals have announced investments and started to operationalize their brownfield expansion as well as expanding geographic reach through greenfield capital projects. Today, we are seeing an increase in capex from hospital chains coming through in a large way. To highlight – Narayana Hryudalaya has invested 1000cr capex in FY23 and will additionally invest another 1,000cr through FY24e with a focus on cardiology and oncology. Currently, the company has 6096 operational beds with an aim to add ~800-1000 more in the next 2 years. Max Healthcare aims to nearly double their bed count in next 5 years, currently operating ~3,500 beds.

Exhibit 12: Excerpt from Max Healthcare’s Q2FY24 investor presentation

Exhibit 13: Occupancy Rates across Hospitals

Alongside the capacity expansion, it is imperative that we measure how occupancy rates fare as well as the newer capex matures. As a hospital’s new beds Capex materializes and gets to a stage of maturity, their increased occupancy would result in higher Fixed Asset Turnover, allowing for faster breakeven on Capex.

Exhibit 14: Occupancy Rates across Hospitals

Banking and Financial Services

We have spoken about our underweight exposure in the banking and financial lending sector vs rest of the industry. In fact, we continue to maintain an extremely bottom-up perspective on banking rather than owning all the top private sector banks in the country. We continue to maintain that while the valuations are attractive, we would want to own the banks tactically rather than on a structural basis.

So why this view?

Its well known that the private sector banks are seeing one of the cleanest phases of balance sheet growth that they have seen in the last 20 years. With capex coming live across government and private sector, the visibility of loan growth seems to be robust. Many of the banks are available at the mean end of the average valuations one has seen over the last 10 years, which has led to the sector being overweight across the country. So why do we differ?

While all the arguments above are valid and coherent, we believe this environment has also led to increased competition, NIM margin compression and the marginal loan being priced at an extremely tight rate. All of these should have an impact on the NIM margin expansion (while the growth rate on the asset side is not at risk). This is one of the reasons we continue to be opportunistic this space and will look at bottom-up opportunities only rather than taking our portfolio to an overweight level today. The trend shown in the same in the two exhibits are shown below.

Exhibit 15: Net Interest Margin trend for Top Banks in India

Exhibit 16: ROA trend for Top Banks in India

The table below, breaks down our sectoral allocation alongside the growth we are seeing in each of the segments.

To summarise, the below table gives an overview of the health of our portfolio as of Q2FY24 (with the snapshot as of September 2023)

** RHIM numbers are adjusted by removing the exceptional item (one-off impairment on goodwill) due to the acquisition. However, the numbers include one-off expense incurred in Q4FY23.

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.