Studying the history of capital markets of India makes one appreciate the importance of FIIs and the flow of capital they bring into our country. As against this backdrop, many investors have paid close attention to the FII flows as a proxy of investing in the Indian equity markets. The question we ask ourselves is, is this attention really warranted?

To understand the allocation of FIIs in the Indian markets, it makes sense to look at the broad trends and the microstructure of India.

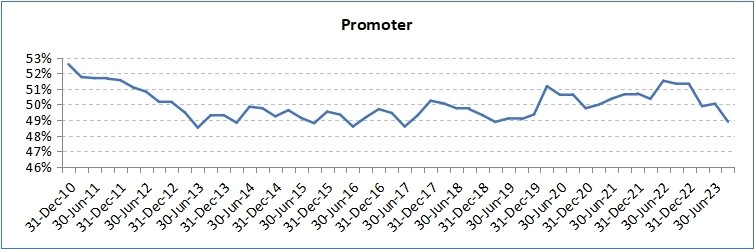

The below Figures are a representation basis the market cap of all companies in India with a market cap of > 1000 cr. This has represented more than 95% of the market cap of India. It is important to appreciate that looking at the allocation in %ages have more relevance than in absolute billions of $s as the market cap has increased by a magnitude of 3.3x over this period.

Fig 1: Promoter holding in the listed universe of Companies of India (Market cap > 1000 Cr)

A few important takeaways

Fig 2: FII Ownership in the Indian Listed Markets (Market cap > 1000 Cr)

Fig 3: DII Ownership in the Indian Listed Markets (Market cap > 1000 Cr)

This is an interesting area to continue to watch.

Fig 4: Retail Ownership in the Indian Listed Markets (Market Cap > 1000 Cr)

For retail, we have bucketed the unallocated portion as retail. Retail will always be important but will continue to be volatile. If this volatility is offset by DII increase, it holds good for the long term.

An important question remains though, does a market’s fundamental strength need to be driven by FII inflows and do we need to continue to monitor this by quarter to determine the strength of the economy.

The second question this normally begets is are FII’s truly long-term and if the flows from them pre-empt a long trend in a country – more specifically an EM country like India.

In order to study this question, one can look at a market close to India which had structural advantages and growth since 2003.

Fig 5: Equity market capitalization growth of China and Mainland Hongkong alongside its GDP Growth

The shaded areas capture the implementation of the Qualified Foreign Institutional Investor programs (QFII and RQFII), the implementation of the Stock Connect program, and the incorporation of domestic listed stocks from China into the MSCI Emerging Markets Index.

Fig 6 : Cumulative equity raised over 2012

Note: This figure presents trends in equity issuance activity for different groups of publicly listed firms with residence and operations in mainland China. Firms subject to the internationalisation episodes substantially increased their equity financing and investments compared to other firms. Although both targeted and untargeted firms showed a similar pattern in equity issuances up to 2013, targeted firms increased their equity issuances relative to untargeted firms since 2014. Connected firms increased their equity issuances relative to unconnected firms (listed domestically) and relative to those listed in foreign markets By 2020, the cumulative amount of equity raised (over initial assets) was 51 percentage points higher for connected firms than for unconnected firms with similar starting characteristics.

The above goes to show that when China opened itself up to foreign capital, it was at the late-stage cycle of its growth and was done predominantly for firms to dilute and raise capital. This is one of the core reasons FII Investors structurally have not made money through their China Allocation.

Fig 7: Cumulative equity raised over 2012

Note: This figure shows differences in investment behavior (for capital expenditures) between connected and unconnected firms with similar balance sheet characteristics in 2010-12. The figure plots the average differences in capital expenditures over 2012 assets for each year between connected and unconnected firms. At the aggregate level, the internationalisation process played a significant role in the amount of equity issued and investments by domestic listed companies. About 28% of the total equity raised, 10% of capital expenditures, 12% of acquisitions, 24% of R&D expenditures, and nearly a quarter of cash and short-term investments made by domestic listed firms during 2013-20 could be associated with this process.

Looking at the China example above, there is very little to show that foreign capital has played a benefit in the growth rate of internationalising China. Quite the contrary, since the advent of foreign capital, the capital misallocation has been higher at large.

While I do not argue for the same for India, I do believe that as investors, tracking domestic flows and the increase in capital is going to be a lot more significant to the growth of the country than worrying about quarterly trends of FII allocation in the country.

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.