Over the last year, investors have often spoken about recession as a potential risk that could cause a downside to the markets. Earlier in the year, active investors in the US were underweight US equities and the follow-on price action in the first half of 2023 has seen the US markets be one of the best performing markets in the year, considering the risk of recession having receded.

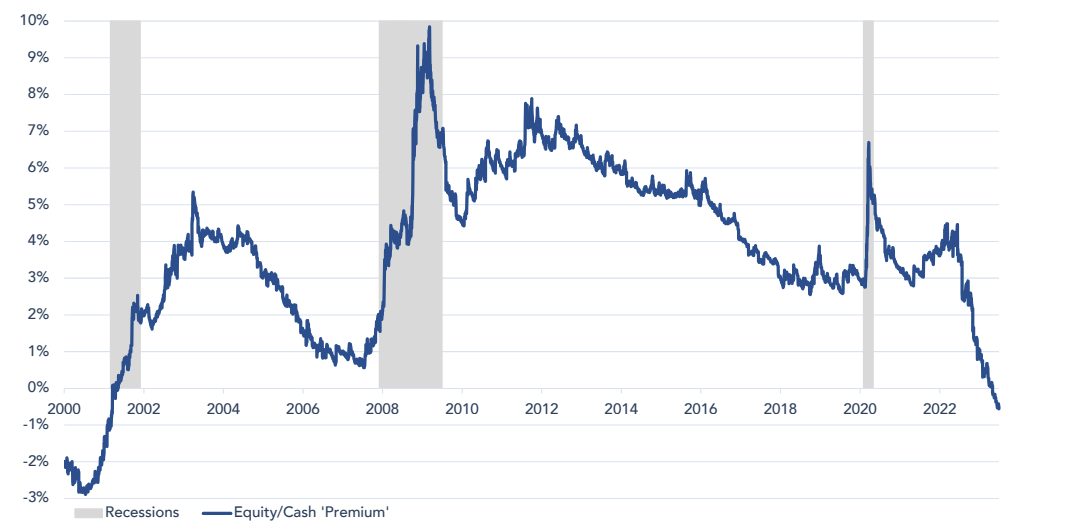

One of the core characteristics of a recession is the occurrence of earnings yield on equities being low relative to Central bank Interest rates (Fig 1 gives a historical perspective of this). Today, this number is negative which makes it interesting to study the narrative – would the yields reduce to justify the move in equities or is risk being mispriced?

Fig 1 : US Equity Earnings Yield Premium to fed Funds

Characteristics of the market

The MSCI World Index which represents ~1,550 companies (the largest, globally) has had a very interesting characteristic this year. Despite the granular diversification, 77% of the returns have come from 7 companies (which represent 16% of the Index). All the companies, contributing to the returns either come from technology or AI and the dispersion of returns is extremely skewed, the first time we have seen this in 40 years.

Fig 2 : MSCI World Index Attribution Analysis

Market narrowness is not a new phenomenon as we have seen this in the past too. However, this time the markets are dominated by passives (33% of the market today is owned by ETFs which are valuation agnostic – The largest one being SPDR ETF (which tracks the S&P 500) managing USD 420 bn today.

Fig 3 : Index / Passive share of the US Market

As John Bogle, the founder of Vanguard and the father of passive investing spoke in 2018, he sees a world where 50% of the equity market will be in passives. While there is nothing to believe that this cannot happen, this will further create a world of extreme narrowness where valuations do not become important. Be definition, new investors of Index funds will be buying less of out-of-favour companies and buying more of the companies with larger market capitalisations that are going up. This will have an adverse reaction at some stage as it is never a healthy sign in the market. With active managers being benchmarked monthly, this will create an environment where the inefficiency in the market will increase but the majority of money will continue to chase the same assets. While its always important for investors to focus on the long-term for asymmetric risk-reward opportunities, that certainly is not happening currently.

As an active manager, it is increasingly important to remain patient as market breadth this narrow eventually does create long-term opportunities. In a market relevant to us at Itus, while the narrowness is not this significant, the ramifications globally has implications for us to watch out too, as the only space that has seen a structural inflow over the last 2 years continue to be passives.

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.