Reviewing Q1 FY24 at Itus (June 23 Earnings Quarter)

We had ended FY23 (March 2023) earnings season, with a robust earnings growth translating into a stronger Cash flow growth in our portfolio companies. One of the characteristics that defined the portfolio was operating leverage, as the capex our portfolio companies was deploying on the ground, was funded through internal accruals and the demand cycle being strong, meant that the cash conversion cycle was lower than the 10Y average we had seen. In line with the robust growth, we had anticipated FY24 to be a year of a relatively muted (lower than prior year) topline growth, offset by better Cash flow growth.

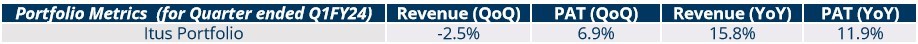

The quarter went by (June 23 – 1QFy24) saw strong annual growth in revenue and profitability across our portfolio. Though the revenue growth was lower on a QoQ basis, which was in line with our expectation, the profitability continued to improve. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q1FY23 to Q1FY24, as compared to Q1FY22 to Q1FY23. This helps us track growth of our portfolio better, removing dependence on cyclicality in the quarter. Our portfolio companies continue to demonstrate healthy growth and profitability.

We also measure the health of the portfolio with the following metrics, that give us a summary of the earning capability of our holdings.

A slowdown in growth but improved margins:

At Itus, we closed FY23 with a revenue growth of 20.5% over FY22 and a PAT growth of 22.7% over the same period. In previous quarters, we had highlighted the inflationary trend on raw material prices across industries that led to gross margin pressure along with global shipping costs that impacted supply chains, margins and pricing power. Over the last 6-12 months, we have seen key raw materials that go into manufacturing – from steel to chemicals reach a normalization to their pre-pandemic commodity prices.

Fig 1: Steel prices have normalised in the last 2Y

While we expect volume to drive growth in FY24 (led by private and government spending on infrastructure, and other capital expenditures), commodity prices normalising would mean passing down costs to consumers. Wholesale Price Index (India) data has been a broad indicator for the same, along with commentary on the ground.

However, in such environments, businesses that grow on volume and can maintain their pricing power will as a result see margin expansion – which is where we position ourselves in our portfolio.

Fig 2: Change in Wholesale Price Index in India over last 10Y

Risk Management

Our core thesis on protecting the portfolio downside comes from two perspectives:

In the below section, we provide highlights on the data points on the ground in terms of growth and pockets of future visibility.

Fig 3: Capex Cycle broken down by its sub-components on the ground measured through flow of capital across the various segments.

Source: RBI, CMIE, Spark Research

Fig 4: Manufacturing led growth and the corresponding Investment on the ground

India is currently going through a manufacturing led growth. History suggests that the GDP per capita of a country that transitions from a 2,500$ per capita to a $5000 per capita is led through an inflection point in manufacturing – countries that went through this growth (namely US, Japan, China, Korea) saw a similar transition, and currently we are in the early stages of a structural growth in India.

In the next section, we highlight a few snippets from con-calls and specific companies on the ground which have a direct impact on the private capex deployment on the ground:

Snippet from Polycab India Q1FY24 Transcript

“As consumption gradually improves, the private sector too has increased its capex plan. In FY23, private sector capex announcements surged to an impressive ₹ 26 trillion, nearly doubling from the previous year’s figures. Sectors such as Chemicals, Air Transport, and Renewables have been leading the charge in these robust investment decisions. In Q1 FY24, private sector capex addition amounted to approximately ₹ 5 trillion, with transport services, chemicals, and power sectors playing a significant role in this growth. The healthy capacity utilization of the manufacturing sector, recorded at 74.3% by the end of CY 2022, has spurred corporates to move beyond “maintenance CAPEX” to “discretionary CAPEX.” This shift is reflected in the capex to depreciation ratio for listed corporates, which rose to 1.6x in FY23 from 1.3x in FY21, demonstrating their willingness to invest in expanding their operations.”

Infrastructure projects are picking up today – which is why we see a pickup in cement and steel volumes. Correspondingly, supply in real-estate and construction has increased in India. This should see a benefit on the upstream and downstream businesses which would have a volume growth due to the new supply of real-estate coming into the market.

Fig 5: Cement production grew 13.2% yoy in Fy23 vs FY22

Fig 6: Supply of new launches in residential real estate across the country

Our portfolio construction at Itus is built to position ourselves in the above pockets of growth, where the supply side of the economy is seeing capex addition on the ground. We continue to allocate exposures to each individual business basis the valuation comfort we find against this growth. The table below, breaks down our sectoral allocation alongside the growth we are seeing in each of the segments.

To summarise, the below table gives an overview of the health of our portfolio as of Q1FY24 (with the snapshot as of June 2023)

* Companies exited during Q1FY24

** RHIM numbers are adjusted by removing the exceptional item (one-off impairment on goodwill) due to the acquisition. However, the numbers include one-off expense incurred in Q4FY23.

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.