Today we would like to highlight some of our Key aspects of account opening and fund reporting with ITUS.

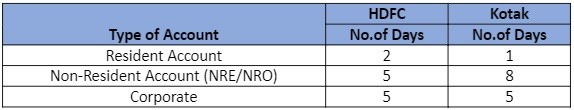

The client accounts will be active with our two largest custodians in the country, Kotak Bank and HDFC Bank, and we’ve designed our reporting to allow our clients and partners daily access to their holdings, transactions, and portfolio value. We want to emphasise the timeframe that we use to setup accounts with both custodians.

We are happy to inform that over the past four quarters, we have consistently kept 85% of the TAT in place. Due to our promptness and thorough client onboarding procedures, 80% of our clients increased their corpus during the first 14 months of their relationship with us.

Here is an article that my colleague Ms. Sunita wrote explaining the value of fund reporting and customer onboarding to our organisation. You might experience the same.

Fund Reporting and Client Induction – ITUS Capital

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital

As a part of our ongoing commitment to keeping you informed, we remain dedicated to our SIP program, providing investors with a convenient avenue to regularly enhance their portfolios. We encourage you to explore the benefits of this program for your clients. If you require more details, please don’t hesitate to reach out to your dedicated relationship manager at [email protected].