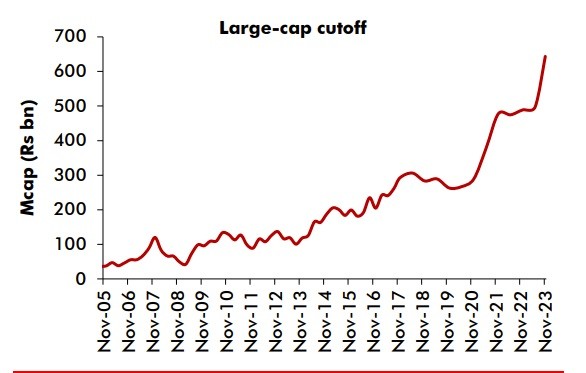

This week, we are featuring an article on Market Cap-based Investing – Understanding Data. You can access the entire article through the provided link for a detailed review. In this communication, we are presenting select charts that highlight the shift of market cap cut-offs over time.

Figure 1 illustrates the historical shift in Large Cap cut-offs. In 2005, the threshold for Large Cap was set at 5000 Cr, whereas today, the lower limit for Large Cap stands at 70,000 Cr. Figure 2, it showcases the shift in Mid Cap cut-offs. In 2005, a 1000 Cr market cap qualified as Mid Cap, but presently, the entry point for Mid Cap in the Indian equity markets on the lower end is at 23,000 Cr. Similarly, Figure 3 depicts the changes in Small Cap cut-offs over time. Currently, the minimum market cap for entry into Small Cap in the Indian equity markets is 7,000 Cr, a significant increase from the 400 Cr threshold observed in 2005.

To read the complete article – https://ituscapital.com/articles/investing-basis-market-caps-understanding-the-data/

Continuously keeping you informed about our SIP program is a key commitment for us as SIP presents investors with a convenient avenue to regularly infuse capital into their portfolios. Feel free to check out the benefits for your clients. If you need more info, reach out to your dedicated relationship manager at [email protected].

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital