Reviewing Q3 FY22 at Itus

The quarter went by saw strong growth in revenue and profitability across our portfolio. There were a few interesting trends in our portfolio companies which we highlight in further detail below:

Note: For the year-on-year (YoY) measurements, we have taken a rolling 4 quarter format, i.e., Q3FY21 to Q3FY22, as compared to Q3FY20 to Q3FY21. This helps us track the growth of our portfolio better, without overt dependence on cyclicality in the quarter.

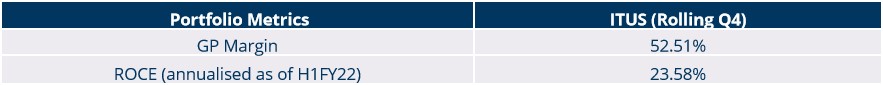

We also measure the health of the portfolio with the following metrics, that give us a summary of the earning capability of our holdings.

In our communication this quarter, we find it imperative to highlight a few themes that have a material impact on risk.

API Starting Material Crunch:

During the past 6-12 months, the margin pressure has been turned on for pharmaceutical companies in India that operate in the bulk drug market. Indian pharmaceutical manufacturers are heavily reliant on China for API (active pharmaceutical ingredients) or KSM (key starting materials) procurement. Roughly 70% of India’s APIs are imported from China, by volume. The reliance on China for some APIs, particularly antibiotics, is over 90%. As a result, the industry has noticed an increase in input costs, which some will be able to pass on, albeit with a lag, depending on which market or molecule is affected.

The restrictions on power consumption in China disrupted manufacturing activities and supply chains, including API and KSM, partly fueled by domestic coal shortage in China and its ambitions in the field of global climate governance. China has implemented revolving power outages across 20 provinces, which has led to production cuts by several API intermediates and starting material manufacturers. Cost of imported APIs and excipients, as well as transportation and packaging materials, were already rising in the industry for the last 12-24 months, which along with China’s power crisis would exacerbate the pricing of the industry.

To highlight the severity of the prices – APIs like as Paracetamol, Meropenem, and Metformin, an anti-diabetic, have risen by 139%, 127%, and 124%, respectively. We expect that Q4FY22 will continue to be a tough quarter for the Indian Pharmaceutical Industry as highlighted by Rajesh Dubey, CFO of Alkem Labs:

“…also API prices have started rising up and it was expected to start giving impact in our COGS in Q3 and going forward. So Q3 also impact to certain extent it is there, but not significant impact, some impact is there, definitely since we ensure our raw material and packing material for at least three months. So whatever high-priced API or packing material we have procured definitely Q4 is going to have major impact. So, we feel somewhere between 2% and 3% of our margin it may get impacted in Q4. So yes in some of the API little bit price softening we have witnessed but our expectation after winter Olympic completion I think that is the time when we have to see how China is behaving and how prices start indicating.”

At Itus, our positioning of the portfolio has been to account for the businesses with the ability to either pass on the prices to the end consumer (focused on branded generics) or those manufacturing molecules where they have a less of an import reliance on China. This has helped managed the downside experienced across a range of pharma companies.

Yield Compression in AMCs:

The AMC business saw yield compression as a common theme among the listed players in their equity book. While the AMC business has seen robust inflows (industry average net inflows of 12%) in the last 1Y (coming from net inflows and SIPs), this has come through with a net yield drop of the equity book. There have been two significant factors that have contributed to the yield drop

While this is a trend that is bound to continue for the next year, we believe AMCs will pass on some of the yield drop to the distribution channel over time.

Rehashing the CEO of HDFC AMC around how he sees the cycle evolve:

“The good news is, industry is realizing and pricing products better. What we saw happening with some of the NFOs in the recent past, is now getting better. Our past experience over the last several years says that far way out of normal pricing can’t last forever. In fact, I would say that actually high distribution cost will ultimately hurt distributor the maximum because direct lines will become cheap and migration from distributor folios to direct folios may happen at a much faster pace.”

At Itus, we had positioned well in this bucket by exiting HDFC AMC two quarters ago. We continue to hold UTI AMC which had a significant AUM growth over the last one year (3x the industry average). UTI AMC had a yield drop in their equity book in line with the industry, however, we believe the focus on the business towards smart beta products, active products and continued performance (alongside showing operational leverage due to expense reduction) provide us with a significant margin of safety.

Raw Material Inflation & Global Shipping – Update:

Last quarter, we had communicated about the raw material inflation and shortage of containers in the global shipping industry. In certain shipping routes, the cost of freight had soared, for example – from China and East Asia to Northern Europe and North America have risen 7 times since the beginning of 2020. Not only does this exacerbate raw material price inflation but also put at risk companies that are reliant on global supply chains.

Fig 1: Freightos Baltic Index (global shipping container cost)

Over the last 3 months, while price of shipping and transportation have not reduced significantly, they have relatively stabilised, allowing for companies to have a greater ability to pass down costs. These pricing increases will eventually be passed down to consumers but at the risk of tapering demand. However, it is important to note that while this crisis still weighs heavily of businesses that are either import/export-oriented, we expect that the pricing should normalize over the next 2-3 quarters, as and when increased container production hits the ground running.

In moments like these, it is all the more important to be disciplined around the kind of business we own and minimize risks where we see them. A crucial aspect we search for – is a company’s capacity to raise prices over inflation without affecting sales or losing existing clients.

In the next section, we briefly cover the investment changes made in the portfolio alongside the rationale for each.

Investment Changes

This past quarter we made a few changes to our investments. We shall highlight our reasoning and thesis for our decisions.

Ahluwalia Contracts:

Ahluwalia Contracts is a niche civil contractor and construction company focused on medical infrastructure projects working with the State Governments of the country. A consequence of the pandemic has been spurred spending in a few places – including healthcare infrastructure and real estate. Funding for Public Health and Hospitals is a state subject, many of whose balance sheets have been stretched. To solve this, the Central Government extends financial support through PM Surakshana Yojana, where the pandemic has given this a renewed push and the allocation to healthcare has jumped 120% in the Central Budget.

Over the last 10 years, the infrastructure sector in the country has been affected due to poor execution on the ground and increased debt & working capital on the balance sheet. As a result of the above happening in parallel, multiple infrastructure companies have gone out of business. Currently, there are only 5 infrastructure companies in India, which have the track record and execution capability to bid on 500 Cr+ projects which puts Ahluwalia Contracts in a unique situation among competition. Ahluwalia went through a tough phase between 2010-2014 due to its exposure in the residential infrastructure, where projects were stalled which put pressure on the working capital and balance sheet of the company. A steady recovery from this, as well as deleveraging, has led to improved financial performance.

Over the last 2 years, the revenue of the company has grown from 1,754 Cr in 2019 to 1,982 Cr in March 2021. In 9MFY22, the company has already generated 1,979 Cr in topline, paving the way for significant YoY growth. This has been accompanied by a PAT Margin increase to 5.7% (This was 3.42% 2 years back). Alongside the cash flows of the company have compounded at a 42% CAGR over the last 3 years.

The company has built a robust order book of INR 6,500 Cr which is to be executed over the next 3 years and continues to build this at a net new inflow of INR 1,500 – 2000 Cr.

We expect the company to close FY22 with a revenue of INR 2,500 Cr and a PAT of 155 Cr. At the current market cap, the company is trading a 12x CF multiple. This gives us a significant margin of safety and we expect the company to grow at a 20% CAGR over the next 3 years with a focus on the balance sheet.

Alembic Pharmaceuticals: (Exit)

Something that has become evident over the last few quarters is that the US-focused generic pharmaceutical companies have all complained about the effect of pricing pressure. Alembic Pharmaceuticals was no exception, with a decline in the US-generics business revenue after a really poor Q1FY22, where we saw degrowth of -37% over Q4FY21. Sequential revenue decline has followed in Q2 and Q3FY22, in the segment. However, The US generics market, despite high expenditure requirement for USFDA standards and regulations, remains the most attractive of markets. High entry barriers, higher drug prices make for good margin contribution. However, the changes we are seeing may be structural in nature.

Two major issues have led to our exit from Alembic Pharmaceuticals:

The growth in domestic revenue is a silver lining, with renewed focus on chronic ailments is benefitting this segment. Growth here was previously in 5-6% CAGR, could potentially scale at 15-20% CAGR till FY24. However, considering the API starting material crisis and decline in US business, we felt it pertinent to trim the risk in our portfolio.

Bata India:

Bata continues to be a leader in the mid-tier pricing footwear segment. During the poor period of operations for the brand, the focus on cash flows has helped the company come out of the crisis in a relatively unharmed manner. As the economy opens up we expect the following drivers to kick in :

In terms of operational changes, the company has gone through two major changes:

We expect Bata to become a 50,000 Cr market cap brand over the next 3 years (the company generating a FCF of 1,000 Cr annually)

FSN E-commerce Ventures:

Nykaa is a e-commerce platform in India that operates in the BPC and Fashion segments. Founded in 2012, Nykaa was able to gain market share and build upon a very nascent online BPC market in India by bringing in popular and global brands, along with build a tight knit distribution chain that gained consumer trust in its platform.

The key crux and pain-point Nykaa attempted to solve is twofold:

Given growth rates of each of the existing major verticals of Nykaa (overall topline expected to scale >40% CAGR), we expect that by FY26, the company’s revenue to be around 114.5 Billion INR. Assumption taken of scaling down costs as a %, we expect that Nykaa will generate 33.5 Billion INR in FCF by FY26. The investment is expected to give us a 20% IRR from the current price at a base case.

Indiamart Intermesh: (Exit)

In the quarter ended December 2021, we exited our investments in Indiamart Intermesh on the following premise:

Table1: Indiamart Intermesh – Operational Metrics

To summarise, here is the health of our portfolio as of Q3FY22.

Team Itus

Disclaimer:

The performance-related information provided in this newsletter/blog is not verified by SEBI. The content is intended solely for internal circulation and general informational purposes. It does not constitute investment advice or any form of financial recommendation.

The research information shared herein may contain inaccuracies or typographical errors. All liability for actions taken or not taken based on the content of this newsletter/blog is expressly disclaimed.

No reader, user, or browser of this Newsletter / blog should act or refrain from acting based on any information in this newsletter/blog without seeking independent financial advice. Use of, and access to, this publication or any links or resources provided within do not establish a portfolio manager-client relationship between the reader, user, or browser and the authors, contributors or Itus Capital.