Last quarter, we have been providing our portfolio earnings report, in which banking has been one sector which is a crucial contributor to the Nifty Market Weights. Our objective is to scrutinize the earnings growth of this sector and determine the sustainability of the index’s earnings growth.

Whilst financial lending has experienced robust growth, we maintain a cautious stance towards investing in banks. Despite private sector banks’ proactive approach to expanding their deposit base and improving their Net Interest Income, we anticipate that the current higher interest rate environment will impede advances growth, unlike the past 2.5 years.

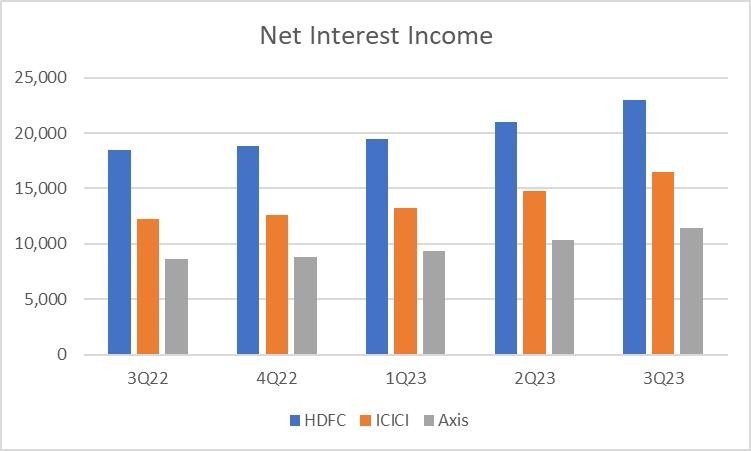

We have provided three charts to illustrate the Net Interest Income, Advance Growth, and Deposits Growth of the three largest private banks – HDFC Bank, ICICI Bank, and Axis Bank. At present, our investment position in banks is underweight, and we intend to add risks to our portfolio selectively, with an emphasis on appropriate valuation.

To read about our Portfolio review for the previous quarter, please click on the below link- https://ituscapital.com/articles/portfolio-review-3q-fy23/

These weekly episodes are now available in our website for your quick read and you may access the same in the below link.

Weekly Enlightenment Archives – ITUS Capital

As a part of our ongoing commitment to keeping you informed, we remain dedicated to our SIP program, providing investors with a convenient avenue to regularly enhance their portfolios. We encourage you to explore the benefits of this program for your clients. If you require more details, please don’t hesitate to reach out to your dedicated relationship manager at [email protected].